Futures contract

From Wikipedia, the free encyclopedia

In finance, a futures contract is a standardized contract, traded on a futures exchange, to buy or sell a specified commodity of standardized quality (which, in many cases, may be such non-traditional "commodities" as foreign currencies, commercial or government paper [e.g., bonds], or "baskets" of corporate equity ["stock indices"] or other financial instruments) at a certain date in the future, at a price (the futures price) determined by the instantaneous equilibrium between the forces of supply and demand among competing buy and sell orders on the exchange at the time of the purchase or sale of the contract. They are contracts to buy or sell at a specific date in the future [1] at a price specified today. The future date is called the delivery date or final settlement date. The official price of the futures contract at the end of a day's trading session on the exchange is called the settlement price for that day of business on the exchange.

A futures contract gives the holder the obligation to make or take delivery under the terms of the contract, whereas an option grants the buyer the right, but not the obligation, to establish a position previously held by the seller of the option. In other words, the owner of an options contract may exercise the contract, but both parties of a "futures contract" must fulfill the contract on the settlement date. The seller delivers the underlying asset to the buyer, or, if it is a cash-settled futures contract, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back (covering) a short position, effectively closing out the futures position and its contract obligations.

Futures contracts, or simply futures, (but not future or future contract) are exchange traded derivatives. The exchange's clearinghouse acts as counterparty on all contracts, sets margin requirements, and crucially also provides a mechanism for settlement.[2]

[edit] Origin

The origins of futures contract can be traced to Ancient Greece, in Aristotle's writings. He tells the story of Thales, a poor philosopher from Miletus who developed a "financial device, which involves a principle of universal application." Thales used his skill in forecasting and predicted that the olive harvest would be exceptionally good the next autumn. Confident in his prediction, he made agreements with local olive-press owners to deposit his money with them to guarantee him exclusive use of their olive presses when the harvest was ready. Thales successfully negotiated low prices because the harvest was in the future and no one knew whether the harvest would be plentiful or pathetic and because the olive-press owners were willing to hedge against the possibility of a poor yield. When the harvest-time came, and many presses were wanted all at once and of a sudden, he let them out at any rate which he pleased, and made a large quantity of money.[3]

The first futures exchange market was the Dōjima Rice Exchange in Japan in the 1730s, to meet the needs of Samurai who – being paid in rice, and after a series of bad harvests – needed a stable conversion to coin.

[edit] Futures versus forwards

While futures and forward contracts are both contracts to deliver an asset on a future date at a prearranged price, they are different in two main respects:

- Futures are exchange-traded, while forwards are traded over-the-counter.

- Thus futures are standardized and face an exchange, while forwards are customized and face a non-exchange counterparty.

- Futures are margined, while forwards are not.

- Thus futures have significantly less credit risk, and have different funding.

[edit] Exchange versus OTC

Futures are always traded on an exchange, whereas forwards always trade over-the-counter, or can simply be a signed contract between two parties.

Thus:

- Futures are highly standardised, being exchange-traded, whereas forwards can be unique, being over-the-counter.

- In the case of physical delivery, the forward contract specifies to whom to make the delivery. The counterparty for delivery on a futures contract is chosen by the clearing house.

[edit] Margining

Forwards transact only when purchased and on the settlement date. Futures, on the other hand, are margined daily, every day to the daily spot price of a forward with the same agreed-upon delivery price and underlying asset (based on mark to market).

The result is that forwards have higher credit risk than futures, and that funding is charged differently.

The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can build up between the forward's delivery price and the settlement price.

This means that one party will incur a big loss at the time of delivery (assuming they must transact at the underlying's spot price to facilitate receipt/delivery).

This in turn creates a credit risk for forwards, but not futures. More generally, the risk of a forward contract is that the supplier will be unable to deliver the required asset, or that the buyer will be unable to pay for it on the delivery day.

The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. This means that there will usually be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the lifetime gain or loss.

In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an individual party, limiting credit risk in futures.

Consider a futures contract with a $100 price: Let's say that on day 50, a futures contract with a $100 delivery price (on the same underlying asset as the future) costs $88. On day 51, that futures contract costs $90. This means that the mark-to-market would require the holder of one side of the future to pay $2 on day 51 to track the changes of the forward price ("post $2 of margin"). This money goes, via margin accounts, to the holder of the other side of the future.

A forward-holder, however, would pay nothing until settlement on the final day, potentially building up a large balance; this may be reflected in the mark by an allowance for credit risk. So, except for tiny effects of convexity bias (due to earning or paying interest on margin), futures and forwards with equal delivery prices result in the same total loss or gain, but holders of futures experience that loss/gain in daily increments which track the forward's daily price changes, while the forward's spot price converges to the settlement price. Thus, while under mark to market accounting, for both assets the gain or loss accrues over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry.

Note that, due to the path dependence of funding, a futures contract is not, strictly speaking, a European derivative: the total gain or loss of the trade depends not only on the value of the underlying asset at expiry, but also on the path of prices on the way. This difference is generally quite small though.

[edit] Nonconvergence

| This section may contain original research or unverified claims. Please improve the article by adding references. See the talk page for details. (April 2008) |

Some exchanges tolerate 'nonconvergence', the failure of futures contracts and the value of the physical commodities they represent to reach the same value on 'contract settlement' day at the designated delivery points. An example of this is the CBOT (Chicago Board of Trade) Soft Red Winter wheat (SRW) futures. SRW futures have settled more than 20¢ apart on settlement day and as much as $1.00 difference between settlement days. Only a few participants holding CBOT SRW futures contracts are qualified by the CBOT to make or receive delivery of commodities to settle futures contracts. Therefore, it's impossible for almost any individual producer to 'hedge' efficiently when relying on the final settlement of a futures contract for SRW. The trend is the CBOT continuing to restrict those entities who can actually participate in settling contracts with commodity to only those that can ship or receive large quantities of railroad cars and multiple barges at a few selected sites. The Commodity Futures Trading Commission, which has oversight of the futures market, has made no comment as to why this trend is allowed to continue since economic theory and CBOT publications maintain that convergence of contracts with the price of the underlying commodity they represent is the basis of integrity for a futures market. It follows that the function of 'price discovery', the ability of the markets to discern the appropriate value of a commodity reflecting current conditions, is degraded in relation to the discrepancy in price and the inability of producers to enforce contracts with the commodities they represent.[4]

[edit] Standardization

Futures contracts ensure their liquidity by being highly standardized, usually by specifying:

- The underlying asset or instrument. This could be anything from a barrel of crude oil to a short term interest rate.

- The type of settlement, either cash settlement or physical settlement.

- The amount and units of the underlying asset per contract. This can be the notional amount of bonds, a fixed number of barrels of oil, units of foreign currency, the notional amount of the deposit over which the short term interest rate is traded, etc.

- The currency in which the futures contract is quoted.

- The grade of the deliverable. In the case of bonds, this specifies which bonds can be delivered. In the case of physical commodities, this specifies not only the quality of the underlying goods but also the manner and location of delivery. For example, the NYMEX Light Sweet Crude Oil contract specifies the acceptable sulphur content and API specific gravity, as well as the pricing point -- the location where delivery must be made.

- The delivery month.

- The last trading date.

- Other details such as the commodity tick, the minimum permissible price fluctuation.

[edit] Margin

To minimize credit risk to the exchange, traders must post a margin or a performance bond, typically 5%-15% of the contract's value.

Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position.

Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers.

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Futures Commission Merchants are responsible for overseeing customer margin accounts. Margins are determined on the basis of market risk and contract value. Also referred to as performance bond margin.

Initial margin is the money required to open a derivatives position (in futures, forex or CFDs) It is a security deposit to ensure that traders have sufficient funds to meet any potential loss from a trade.

If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned.

In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Often referred to as “variation margin”, margin called for this reason is usually done on a daily basis, however, in times of high volatility a broker can make a margin call or calls intra-day.

Calls for margin are usually expected to be paid and received on the same day. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin. After the position is closed-out the client is liable for any resulting deficit in the client’s account.

Some US Exchanges also use the term “maintenance margin”, which in effect defines by how much the value of the initial margin can reduce before a margin call is made. However, most non-US brokers only use the term “initial margin” and “variation margin”.

The Initial Margin requirement is established by the Futures exchange, in contrast to other securities Initial Margin which is set by the Federal Reserve in the U.S. Markets.

A futures account is marked to market daily. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level.

Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in his margin account.

Margin-equity ratio is a term used by speculators, representing the amount of their trading capital that is being held as margin at any particular time. The low margin requirements of futures results in substantial leverage of the investment. However, the exchanges require a minimum amount that varies depending on the contract and the trader. The broker may set the requirement higher, but may not set it lower. A trader, of course, can set it above that, if he doesn't want to be subject to margin calls.

Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit.

Return on margin (ROM) is often used to judge performance because it represents the gain or loss compared to the exchange’s perceived risk as reflected in required margin. ROM may be calculated (realized return) / (initial margin). The Annualized ROM is equal to (ROM+1)(year/trade_duration)-1. For example if a trader earns 10% on margin in two months, that would be about 77% annualized.

[edit] Settlement

Settlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract:

- Physical delivery - the amount specified of the underlying asset of the contract is delivered by the seller of the contract to the exchange, and by the exchange to the buyers of the contract. Physical delivery is common with commodities and bonds. In practice, it occurs only on a minority of contracts. Most are cancelled out by purchasing a covering position - that is, buying a contract to cancel out an earlier sale (covering a short), or selling a contract to liquidate an earlier purchase (covering a long). The Nymex crude futures contract uses this method of settlement upon expiration.

- Cash settlement - a cash payment is made based on the underlying reference rate, such as a short term interest rate index such as Euribor, or the closing value of a stock market index. A futures contract might also opt to settle against an index based on trade in a related spot market. Ice Brent futures use this method.

Expiry (or Expiration in the U.S.) is the time and the day that a particular delivery month of a futures contract stops trading and the final settlement price for that contract month and year obtains. For many equity index and interest rate futures contracts (as well as for most equity options), this happens on the third Friday of certain trading month. On this day the t+1 futures contract becomes the t futures contract. For example, for most CME and CBOT contracts, at the expiration of the December contract, the March futures become the nearest contract. This is an exciting time for arbitrage desks, which try to make quick profits during the short period (perhaps 30 minutes) during which the underlying cash price and the futures price sometimes struggle to converge. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. At this moment also, the increase in volume is caused by traders rolling over positions to the next contract or, in the case of equity index futures, purchasing underlying components of those indexes to hedge against current index positions. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour.

[edit] Pricing

The situation where the price of a commodity for future delivery is higher than the spot price, or where a far future delivery price is higher than a nearer future delivery, is known as contango. The reverse, where the price of a commodity for future delivery is lower than the spot price, or where a far future delivery price is lower than a nearer future delivery, is known as backwardation.

When the deliverable asset exists in plentiful supply, or may be freely created, then the price of a future is determined via arbitrage arguments. The forward price represents the expected future value of the underlying discounted at the risk free rate—as any deviation from the theoretical price will afford investors a riskless profit opportunity and should be arbitraged away; see rational pricing of futures.

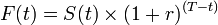

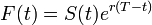

Thus, for a simple, non-dividend paying asset, the value of the future/forward, F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

or, with continuous compounding

This relationship may be modified for storage costs, dividends, dividend yields, and convenience yields.

In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections (transaction costs, differential borrowing and lending rates, restrictions on short selling) that prevent complete arbitrage. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price.

The above relationship, therefore, is typical for stock index futures, treasury bond futures, and futures on physical commodities when they are in supply (e.g. on corn after the harvest). However, when the deliverable commodity is not in plentiful supply or when it does not yet exist, for example on wheat before the harvest or on Eurodollar Futures or Federal funds rate futures (in which the supposed underlying instrument is to be created upon the delivery date), the futures price cannot be fixed by arbitrage. In this scenario there is only one force setting the price, which is simple supply and demand for the future asset, as expressed by supply and demand for the futures contract.

In a deep and liquid market, this supply and demand would be expected to balance out at a price which represents an unbiased expectation of the future price of the actual asset and so be given by the simple relationship

.

.

In fact, this relationship will hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. In other words: a futures price is martingale with respect to the risk-neutral probability.

With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity.

In a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants (an illegal action known as cornering the market), the market clearing price for the future may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break down.

[edit] Futures contracts and exchanges

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links. For a list of tradable commodities futures contracts, see List of traded commodities.

Trading on commodities began in Japan in the 18th century with the trading of rice and silk, and similarly in Holland with tulip bulbs. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery (also called spot or cash market) or for forward delivery. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates.

Contracts on financial instruments was introduced in the 1970s by the Chicago Mercantile Exchange(CME) and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange in 1982 (now Euronext.liffe), Deutsche Terminbörse (now Eurex) and the Tokyo Commodity Exchange (TOCOM). Today, there are more than 75 futures and futures options exchanges worldwide trading to include:

- CME Group (formerly CBOT and CME) -- Currencies, Various Interest Rate derivatives (including US Bonds); Agricultural (Corn, Soybeans, Soy Products, Wheat, Pork, Cattle, Butter, Milk); Index (Dow Jones Industrial Average); Metals (Gold, Silver), Index (NASDAQ, S&P, etc)

- ICE Futures - the International Petroleum Exchange trades energy including crude oil, heating oil, natural gas and unleaded gas and merged with IntercontinentalExchange(ICE)to form ICE Futures.

- LIFF - EURIBOR, FTSE 100, CAC 40, AEX Index

- South African Futures Exchange - SAFEX

- Sydney Futures Exchange

- London Commodity Exchange - softs: grains and meats. Inactive market in Baltic Exchange shipping.

- Tokyo Stock Exchange TSE (JGB Futures, TOPIX Futures)

- Tokyo Commodity Exchange TOCOM

- Tokyo Financial Exchange TFX (Euroyen Futures, OverNight CallRate Futures, SpotNext RepoRate Futures)

- Osaka Securities Exchange OSE (Nikkei Futures, RNP Futures)

- London Metal Exchange - metals: copper, aluminium, lead, zinc, nickel, tin and steel

- New York Board of Trade - softs: cocoa, coffee, cotton, orange juice, sugar

- New York Mercantile Exchange - energy and metals: crude oil, gasoline, heating oil, natural gas, coal, propane, gold, silver, platinum, copper, aluminum and palladium

- Dubai Mercantile Exchange

- Korea Exchange - KRX

- Singapore International Monetary Exchange (SIMEX)

- Futures on many Single-stock futures

[edit] Who trades futures?

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

For example, in traditional commodity markets, farmers often sell futures contracts for the crops and livestock they produce to guarantee a certain price, making it easier for them to plan. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. In modern (financial) markets, "producers" of interest rate swaps or equity derivative products will use financial futures or equity index futures to reduce or remove the risk on the swap.

The social utility of futures markets is considered to be mainly in the transfer of risk, and increase liquidity between traders with different risk and time preferences, from a hedger to a speculator for example.

[edit] Options on futures

In many cases, options are traded on futures. A put is the option to sell a futures contract, and a call is the option to buy a futures contract. For both, the option strike price is the specified futures price at which the future is traded if the option is exercised. See the Black-Scholes model, which is the most popular method for pricing these option contracts.

[edit] Futures contract regulations

All futures transactions in the United States are regulated by the Commodity Futures Trading Commission (CFTC), an independent agency of the United States government. The Commission has the right to hand out fines and other punishments for an individual or company who breaks any rules. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands out.

The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. These reports are released every Friday (including data from the previous Tuesday) and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. This type of report is referred to as the 'Commitments of Traders Report', COT-Report or simply COTR.

[edit] See also

- List of finance topics

- Agriculture

- Freight derivatives

- List of traded commodities

- Seasonal spread trading

- Prediction market

- 1256 Contract

[edit] Notes

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 288. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

- ^ Hull, John C. (2005), Options, Futures and Other Derivatives (excerpt by Fan Zhang) (6th ed.), Prentice-Hall, ISBN 0131499084, http://fan.zhang.gl/ecref/futures

- ^ Aristotle, Politics, trans. Benjamin Jowett, vol. 2, The Great Books of the Western World, book 1, chap. 11, p. 453.

- ^ Henriques, D Mysterious discrepancies in grain prices baffle experts, International Herald Tribune, March 23, 2008. Accessed April 12, 2008

[edit] References

- Hull, John C. (2006). Options, Futures, and Other Derivatives (6th edition ed.). Upper Saddle River, NJ: Prentice-Hall. ISBN 0131499084.

- Redhead, Keith (1997). Financial Derivatives: An Introduction to Futures, Forwards, Options and Swaps. London: Prentice-Hall. ISBN 013241399X.

- Lioui, Abraham; Poncet, Patrice (2005). Dynamic Asset Allocation with Forwards and Futures. New York: Springer. ISBN 0387241078.

- Valdez, Steven (2000). An Introduction To Global Financial Markets (3rd edition ed.). Basingstoke, Hampshire: Macmillan Press. ISBN 0333764471.

- Arditti, Fred D. (1996). Derivatives: A Comprehensive Resource for Options, Futures, Interest Rate Swaps, and Mortgage Securities. Boston: Harvard Business School Press. ISBN 0875845606.

[edit] Futures exchanges and regulators

- Chicago Board of Trade

- Chicago Mercantile Exchange

- Commodity Futures Trading Commission

- National Futures Association

- Kansas City Board of Trade

- New York Board of Trade

[edit] External links

- Curving Futures : Plotting current and historic market data

- Futures Educational Forum

- Guide to Risk in Futures Trading

- Man Financial : A Guide to Margins & Order Entry

- Hot Commodities, Stuffed Markets, and Empty Bellies: What's behind higher food prices? from Dollars & Sense, July/August 2008

- BBC Oil Futures Investigation

- Comparison of forward and futures contracts

|

||||||||||||||||||||||||||||||||||