Georgism

From Wikipedia, the free encyclopedia

- "Georgist" redirects here. For the Romanian political group, see National Liberal Party-Brătianu.

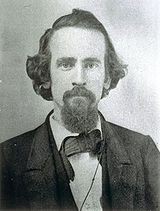

Georgism, named after Henry George (1839-1897) is a philosophy and economic ideology that holds that everyone owns what they create, but that everything found in nature, most importantly land, belongs equally to all humanity. Georgism is also referred to as geoism,[1] by those who feel a more generic term is desirable.[2] Georgism has also been synonymous with a single tax on land.

Contents |

[edit] Main tenets

Henry George is best known for his argument that the economic rent from land should be shared equally by society rather than falling into hands of private individuals. The clearest statement of this view is found in Progress and Poverty: "We must make land common property."[3] Although this could be done by nationalising land and then leasing it out, George preferred taxing unimproved land value, in part because this would be less disruptive and controversial in a country where land titles have already been granted to individuals. With the revenue from this "single tax", the state could avoid having to tax any other type of income, wealth or transactions. Introducing a large land value tax would cause the value of land titles to fall significantly, but George was uncompromising on the idea of compensation for landowners, seeing the issue as a parallel to the earlier debate about compensating former slave owners.

Georgists also argue that all of the economic rent (i.e., unearned income) collected from natural resources (land, mineral extraction, the broadcast spectrum, tradable emission permits, fishing quotas, airway corridor use, space orbits, etc.) and extraordinary returns from natural monopolies should go to the community rather than a private owner, and that no other taxes or burdensome economic regulations should be levied. In practice, the elimination of all other taxes implies a high land value tax, and a correspondingly sharp drop in the value of land ownership, although there would be no change in land rental prices (other than those caused by reduction of other taxes and regulations) for reasons first explained by Adam Smith in his book The Wealth of Nations.[4]

Standard economic theory recognizes that a land value tax would be extremely efficient.[5] Modern economists like the 1976 Nobel Memorial Prize winner Milton Friedman agree that Henry George's land tax is potentially beneficial because unlike other taxes, land taxes do not distort economic activity, and imposes no excess burden on the economy. A replacement of other more distortionary taxes with a land tax would thus improve economic welfare.[6]

The idea of the earth as the common property of humanity has also resonated with modern-day environmentalists, and some have endorsed the idea of ecological tax reform as a replacement for command and control regulation. This would entail substantial taxes or fees for pollution, waste disposal and resource exploitation, or equivalently a cap and trade system where permits are auctioned to the highest bidder. This would also include taxes on the use of land and other natural resources.

[edit] Synonyms and variants

Most early advocacy groups described themselves as Single Taxers, and George endorsed this as being an accurate description of the movement's main political goal – the replacement of all taxes with a land value tax. In the modern era, some groups inspired by Henry George place more of an emphasis on environmentalism, while others place more emphasis on his ideas on economics.

As the world became economically more complex, and the government grew to become a larger part of the economy, an abrupt change to a single land value tax became correspondingly more difficult, and so the term "Georgist" has come into vogue. This more general term encompasses the idea of incremental changes towards the elimination of unjust and economically destructive taxes on economic activity, by recovering the economic rent from land for the benefit of the entire society.

Some adherents are not entirely satisfied with the label Georgist. Henry George is now little known and the idea of a single tax on land predates him. Some now use the term "Geoism", with the meaning of "Geo" deliberately ambiguous. "Earth Sharing", "Geoism", "Geonomics" and "Geolibertarianism" (see libertarianism) are also preferred by some Georgists; "Geoanarchism" is another one. These terms reflect a difference of emphasis, and sometimes real differences about how land rent should be spent (citizen's dividend or just replacing other taxes); but all agree that land rent should be recovered from its private recipients.

[edit] Influence

During its heyday, several communities were founded along Georgist principles. Two such still existing communities are Arden, Delaware, which was founded in 1900 by Frank Stephens and Will Price, and Fairhope, Alabama, which was founded in 1894 under the auspices of the Fairhope Single Tax Corporation.

The German protectorate of Jiaozhou Bay (also known as Kiaochow) in China fully implemented Georgist policy. Its sole source of government revenue was the land value tax of six percent which it levied on its territory. The colony existed from 1898 until 1914.

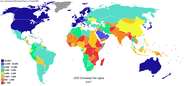

In UK in 1909, the Liberal Government of the day attempted to implement his ideas as part of the People's Budget. This caused a crisis which led indirectly to reform of the House of Lords. George's ideas were also taken up to some degree in Australia, Hong Kong, Singapore, South Africa, South Korea, and Taiwan. In these countries, governments still levy some form of land value tax, albeit with exemptions.[7]

In Denmark, the Georgist Justice Party has previously been represented in Folketinget. It formed part of a centre-left government 1957-60 and was also represented in the European Parliament 1978-79.

In the 2004 Presidential campaign, Ralph Nader mentioned Henry George in his platform.[8]

Hong Kong is perhaps the best example today of a successful implementation of a high land value tax. The Hong Kong government generates more than 35% of its revenue from land taxes.[9] Because of this, it can keep other taxes low or non-existent, and still maintain a budget surplus.

[edit] Criticism

Although both advocated worker's rights, Henry George and Karl Marx were antagonists. Marx saw the Single Tax platform as a step backwards from the transition to communism. He argued that, "The whole thing is...simply an attempt, decked out with socialism, to save capitalist domination and indeed to establish it afresh on an even wider basis than its present one."[10] Marx also criticized the way land value tax theory emphasizes the value of land, arguing that, "His fundamental dogma is that everything would be all right if ground rent were paid to the state."[10]

On his part, Henry George predicted that if Marx's ideas were tried the likely result would be a dictatorship.[11] Fred Harrison provides a full treatment of Marxist objections to land value taxation and Henry George in "Gronlund and other Marxists - Part III: nineteenth-century Americas critics", American Journal of Economics and Sociology, (Nov 2003).[12]

More recent critics have claimed that the increasing complexity of nations has made a land tax insufficient to fully fund government, although it appears to have been enough in George's day. Also, George has been accused of exaggerating the importance of his "all-devouring rent thesis" in claiming that it is the primary cause of poverty and injustice in society, though it clearly is important. [13]

[edit] Predecessors

Those who expressed similar thoughts before Henry George include:

- John Locke,[14]

- John Stuart Mill,[15]

- William Ogilvie of Pittensear,[16]

- Thomas Paine (notably in "Agrarian Justice"),[17]

- Adam Smith,[18]

- Thomas Spence

- Herbert Spencer,[19] and

- the Physiocrats.

[edit] Famous Georgists

- William F. Buckley, Jr. [20]

- Winston Churchill [21]

- Clarence Darrow[22]

- Henry Ford[23]

- Mason Gaffney

- David Lloyd George [24]

- George Grey [25]

- Walter Burley Griffin[26]

- Fred Harrison

- William Morris Hughes

- Aldous Huxley

- Mumia Abu-Jamal[27]

- Tom L. Johnson

- Wolf Ladejinsky [28]

- Francis Neilson

- Albert Jay Nock

- Sun Yat Sen[29]

- Herbert Simon

- Leo Tolstoy[30]

- Mark Twain [31]

- William Simon U'Ren

- William Vickrey [32].

- Blas Infante, Father of Andalusia [33]

- Samuel Milton "Golden Rule" Jones, Mayor of Toledo

[edit] Notes

- ^ Foldvary, Fred E. Geoism and Libertarianism. The Progress Report. [1]

- ^ Smith, Jefferey. Georgist Journal. No. 47. p. 7

- ^ George, Henry (1879). "2". Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth. VI. http://www.econlib.org/library/YPDBooks/George/grgPP26.html. Retrieved on 2008-05-12.

- ^ The Wealth of Nations Book V, Chapter 2, Article I: Taxes upon the Rent of Houses:

-

- Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground. More or less can be got for it according as the competitors happen to be richer or poorer, or can afford to gratify their fancy for a particular spot of ground at a greater or smaller expense. In every country the greatest number of rich competitors is in the capital, and it is there accordingly that the highest ground-rents are always to be found. As the wealth of those competitors would in no respect be increased by a tax upon ground-rents, they would not probably be disposed to pay more for the use of the ground. Whether the tax was to be advanced by the inhabitant, or by the owner of the ground, would be of little importance. The more the inhabitant was obliged to pay for the tax, the less he would incline to pay for the ground; so that the final payment of the tax would fall altogether upon the owner of the ground-rent.

-

- ^ Land Value Taxation: An Applied Analysis, William J. McCluskey, Riël C. D. Franzsen

- ^ Foldvary, Fred E. "Geo-Rent: A Plea to Public Economists" (April 2005). [2]

- ^ Gaffney, M. Mason. "Henry George 100 Years Later". Association for Georgist Studies Board. http://www.georgiststudies.org/george100years.html. Retrieved on 2008-05-12.

- ^ http://web.archive.org/web/20040828085138/http://www.votenader.org/issues/index.php?cid=7

- ^ "'Land Tax' and high land prices in Hong Kong". Policy Papers. Hong Kong Democratic Foundation. http://www.hkdf.org/pr.asp?func=show&pr=24. Retrieved on 2008-05-12.

- ^ a b Karl Marx - Letter to Friedrich Adolph Sorge in Hoboken

- ^ Henry George's Thought [1878822810] - $49.95 : Zen Cart!, The Art of E-commerce

- ^ 14 Gronlund and other Marxists - Part III: nineteenth-century Americas critics | American Journal of Economics and Sociology, The | Find Articles at BNET

- ^ Critics of Henry George

- ^ Are you a Real Libertarian, or a Royal Libertarian ::Furthermore, Locke based his scenario on pre-monetary societies, where a landholder would find that "it was useless, as well as dishonest, to carve himself too much, or take more than he needed." With the introduction of money, Locke noted, all land quickly became appropriated. Why? Because with money, those who can take more land than they have personal use for suddenly have reason to do so, as between them they will have taken all the land, and others will have to pay rent to them. So, with the introduction of money, the Lockean rationale for landed property falls apart, even according to Locke. And while Locke did not propose a remedy specifically for to this problem, he repeatedly stated that all taxes should be on real estate.

- ^ Principles of Political Economy Book 5 Chapter 2:

-

- The ordinary progress of a society which increases in wealth, is at all times tending to augment the incomes of landlords; to give them both a greater amount and a greater proportion of the wealth of the community, independently of any trouble or outlay incurred by themselves. They grow richer, as it were in their sleep, without working, risking, or economizing. What claim have they, on the general principle of social justice, to this accession of riches? In what would they have been wronged if society had, from the beginning, reserved the right of taxing the spontaneous increase of rent, to the highest amount required by financial exigencies?

-

- ^ http://www.wealthandwant.com/docs/Ogilvie_Essay_1782.html An Essay on the Right of Property in Land by William Ogilvie, of Pittensear, Professor of Humanity and Lecturer on Political and Natural History, Antiquities, Criticism, and Rhetoric in the University and King's College of Aberdeen 1782

- ^ Agrarian Justice paragraph 12:

-

- Every proprietor, therefore, of cultivated lands, owes to the community a ground-rent (for I know of no better term to express the idea) for the land which he holds; and it is from this ground-rent that the fund proposed in this plan is to issue.

-

- ^ The Wealth of Nations, Book V, Article I, "Taxes upon the Rent of Houses"

- ^ Social Statics Part 2 Chapter 9: The Right to the Use of the Earth

- ^ http://www.wealthandwant.com/docs/Buckley_HG.html William F. Buckley, Jr. Transcript of an interview with Brian Lamb, CSpan Book Notes, April 2-3, 2000

- ^ Winston Churchill: Land Price as a Cause of Poverty

- ^ Transcript of a speech by Darrow on taxation

- ^ Transcript of 1942 interview with Henry Ford in which he says, "The time will come when not an inch of the soil, not a single crop, not even weeds, will be wasted. Then every American family can have a piece of land. We ought to tax all idle land the way Henry George said — tax it heavily, so that its owners would have to make it productive".

- ^ People's Budget

- ^ The Life of Henry George, Part 3 Chapter X1

- ^ Co-founder of the Henry George Club, Australia.

- ^ Justice for Mumia Abu-Jamal

- ^ Andelson Robert V. (2000), Land-Value Taxation Around the World: Studies in Economic Reform and Social Justice Malden, MA:Blackwell Publishers, Inc. Page 359.

- ^ Spence, Alan (1993), Sun Yat Sen -- Revolutionary Land Reformer, Land & Liberty, July-August 1993

- ^ .Article on Tolstoy, Proudhon and George. Count Tolstoy once said of George, "People do not argue with the teaching of George, they simply do not know it".

- ^ Archimedes[3], an article originally bylined "Twark Main"

- ^ Bill Vickrey - In Memoriam

- ^ Arcas Cubero, Fernando: El movimiento georgista y los orígenes del Andalucismo : análisis del periódico "El impuesto único" (1911-1923). Málaga : Editorial Confederación Española de Cajas de Ahorros, 1980. ISBN 8450037840