Barter

From Wikipedia, the free encyclopedia

| This article is in need of attention from an expert on the subject. WikiProject Business_and_Economics or the Business_and_Economics Portal may be able to help recruit one. (November 2008) |

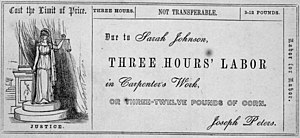

Barter is a medium in which goods or services are directly exchanged for other goods and/or services, without the use of money.[1] It can be bilateral or multilateral, and usually exists parallel to monetary systems in most developed countries, though to a very limited extent. Barter usually replaces money as the method of exchange in times of monetary crisis, when the currency is unstable and devalued by hyperinflation.

Contents |

[edit] History

Contrary to popular conception, there is no evidence of a society or economy that relied primarily on barter.[2] Instead, non-monetary societies operated largely along the principles of gift economics. When barter did in fact occur, it was usually between either complete strangers or would-be enemies.[3]

While one-to-one bartering is practised between individuals and businesses on an informal basis, organized barter exchanges have developed to conduct third party bartering. The barter exchange operates as a broker and bank and each participating member has an account which is debited when purchases are made, and credited when sales are made. With the removal of one-to-one bartering, concerns over unequal exchanges are reduced.

Modern trade and barter has developed into a sophisticated tool to help businesses increase their efficiencies by monetizing their unused capacities and excess inventories. The worldwide organized barter exchange and trade industry has grown to an $8 billion a year industry and is used by thousands of businesses and individuals. The advent of the Internet and sophisticated relational database software programs has further advanced the barter industry's growth. Organized barter has grown throughout the world to the point now where virtually every country has a formalized barter and trade network of some kind. Complex business models based on the concept of barter are today possible since the advent of Web 2.0 technologies.

Bartering benefits companies and countries that see a mutual benefit in exchanging goods and services rather than cash, and it also enables those who are lacking hard currency to obtain goods and services. To make up for a lack of hard currency, Thailand's township, Amphoe Kut Chum, once issued its own local scrip called Bia Kut Chum: Bia is Thai for cowry shell, was once 1⁄6400 Baht, and is still current in metaphorical expressions. Running afoul of national currency laws, the community changed to barter coupons called Boon Kut Chum that bear a fixed value in baht, which they swap for goods and services within the community.[4]

[edit] Trade exchanges

A trade or barter exchange is a commercial organization that provides a trading platform and bookkeeping system for its members or clients. The member companies buy and sell products and services to each other using an internal currency known as barter or trade dollars. Modern barter and trade has evolved considerably to become an effective method of increasing sales, conserving cash, moving inventory, and making use of excess production capacity for businesses around the world. Businesses in a barter earn trade credits (instead of cash) that are deposited into their account. They then have the ability to purchase goods and services from other members utilizing their trade credits – they are not obligated to purchase from who they sold to, and vice versa. The exchange plays an important role because they provide the record-keeping, brokering expertise and monthly statements to each member. Commercial exchanges make money by charging a commission on each transaction either all on the buy side, all on the sell side, or a combination of both. Transaction fees typically run between 8 and 15%.

It is estimated that over 350,000 businesses in the United States are involved in barter exchange activities. There are approximately 400 commercial and corporate barter companies serving all parts of the world. There are many opportunities for entrepreneurs to start a barter exchange. Several major cities in the U.S. and Canada do not currently have a local barter exchange. There are two industry groups, the National Association of Trade Exchanges (NATE) and the International Reciprocal Trade Association (IRTA). Both offer training and promote high ethical standards among their members. Moreover, each has created it own currency through which its member barter companies can trade. NATE's currency is the known as the BANC and IRTA's currency is called Universal Currency (UC).

Exchange systems provide new sales and higher volumes of business, conserving cash for essential expenditures, exchange of unproductive assets for valuable products or services, reduction of unit costs, and opening new outlets for excess inventory and unused capacity. Reciprocal trade finance enables a firm to buy using its incremental cost of production. So long as incremental revenue exceeds incremental cost, it is worth it for a firm to trade using a barter exchange.

There are many reasons to use a good barter exchange:

- Increased purchasing power

- Increased revenue

- Preserving cash

- More clients (both from the barter exchange and from cash-business referrals from barter clients)

- Better cash flow

- Greater marketing opportunities

- Improved efficiency

Organized barter companies also have many more benefits over conventional advertising methods since they are much more proactive. Barter members call into the exchange brokerage with things they need and the brokers match those needs with other members that can fill them.

The first exchange system was the Swiss WIR Bank. It was founded in 1934 as a result of currency shortages after the stock market crash of 1929. "WIR" is both an abbreviation of Wirtschaftsring and the word for "we" in German, reminding participants that the economic circle is also a community. Only SME can join WIR. Its purpose is to encourage participating members to put their buying power at each others disposal and keep it circulating within their ranks, thereby providing members with additional sales volume. WIR has grown to 62,000 members, trading approximately the value of 3 billion Swiss Franc. The offering of goods and services for WIR is promoted by the fact that every official participant is obligated to accept payment in WIR for at least 30% of the first 2000 francs of the selling price, and every loan holder must amortize his/her debt by selling goods/services for WIR. It also means to have fun and be cool with friends

[edit] Corporate barter

Corporate barter focuses on larger transactions, which is different from a traditional, retail oriented barter exchange. Corporate barter exchanges typically use media and advertising as leverage for their larger transactions. It entails the use of a currency unit called a "trade-credit". The trade-credit must be known and guaranteed (contract to eliminate ambiguity and risk).

[edit] Swapping

Swapping is the increasingly prevalent informal bartering system in which participants in Internet communities trade items of comparable value on a trust basis.

While swapping is an excellent way to find and obtain items that are inexpensive, it relies upon honesty. A dishonest participant might arrange a swap, and then never complete their end of the transaction, thus getting something for nothing. This practice is called swaplifting,[citation needed] a pun on shoplifting. The victim's recourse is often limited to shunning the swaplifter, or taking him to small claims court. One way that swaplifting may be combated is by arranging the deal through a third party web service such as FavorTree.net (for services) which has become a favorite among established business men and women, www.swaptree.com (for books and media materials), or one of the other major bartering websites. Typically, these websites do not take on the risk of forcing the other party to follow through on its end of the deal, but they will provide recourse in the form of removing the violator from the site or allowing the wronged party to provide negative feedback (much like eBay or Amazon). Notwithstanding the risk of dishonesty, bartering sites are becoming increasingly popular during tight economic times.

[edit] Tax implications

In the United States, the sales a barter exchange makes are considered taxable revenue by the IRS and the gross amount of a barter exchange member's sales are reported to the IRS by the barter exchange via a 1099-B form. The requirement for barter exchanges to report members sales was enacted in the Tax Equity & Fair Responsibility Act of 1982. According to the IRS, "The fair market value of goods and services exchanged must be included in the income of both parties."[5] Other countries do not have the reporting requirement that the U.S. does concerning proceeds from barter transactions. However, if you barter for goods and/or services, you are taxed not more or less than if it were a cash transaction. In other words, it is handled the same way as a cash transaction regarding taxation. If you bartered for a profit, you pay the appropriate tax, if you generated a loss in the transaction, you have a loss. Bartering for business is also taxed accordingly as business income or business expense.

[edit] See also

[edit] References

- ^ O'Sullivan, Arthur; Steven M. Sheffrin (2003). Economics: Principles in Action. Pearson Prentice Hall. p. 243. ISBN 0-13-063085-3.

- ^ Mauss, Marcel. 'The Gift: The Form and Reason for Exchange in Archaic Societies.' pp. 36-37.

- ^ Graeber, David. 'Toward an Anthropological Theory of Value'. pp. 153-154.

- ^ A Boon to Kut Chum archive

- ^ http://www.irs.gov/taxtopics/tc420.html Tax Topics - Topic 420 Bartering Income.