Stock

From Wikipedia, the free encyclopedia

|

This article or section has multiple issues. Please help improve the article or discuss these issues on the talk page.

|

In business and finance, a share (also referred to as equity share) of stock means a share of ownership in a corporation (company). In the plural, stocks is often used as a synonym for shares especially in the United States, but it is less commonly used that way outside of North America.[1]

In the United Kingdom, South Africa, and Australia, stock can also refer to completely different financial instruments such as government bonds or, less commonly, to all kinds of marketable securities.[2]

Contents |

[edit] Types of stock

Stock typically takes the form of shares of either common stock or preferred stock. As a unit of ownership, common stock typically carries voting rights that can be exercised in corporate decisions. Preferred stock differs from common stock in that it typically does not carry voting rights but is legally entitled to receive a certain level of dividend payments before any dividends can be issued to other shareholders.[1][2] Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares, usually anytime after a predetermined date. Shares of such stock are called "convertible preferred shares" (or "convertible preference shares" in the UK)

Although there is a great deal of commonality between the stocks of different companies, each new equity issue can have legal clauses attached to it that make it dynamically different from the more general cases. Some shares of common stock may be issued without the typical voting rights being included, for instance, or some shares may have special rights unique to them and issued only to certain parties. Note that not all equity shares are the same.[1][2]

[edit] Stock derivatives

A stock derivative is any financial instrument which has a value that is dependent on the price of the underlying stock. Futures and options are the main types of derivatives on stocks. The underlying security may be a stock index or an individual firm's stock, e.g. single-stock futures.

Stock futures are contracts where the buyer is long, i.e., takes on the obligation to buy on the contract maturity date, and the seller is short, i.e., takes on the obligation to sell. Stock index futures are generally not delivered in the usual manner, but by cash settlement.

A stock option is a class of option. Specifically, a call option is the right (not obligation) to buy stock in the future at a fixed price and a put option is the right (not obligation) to sell stock in the future at a fixed price. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. The most popular method of valuing stock options is the Black Scholes model.[3] Apart from call options granted to employees, most stock options are transferable.

[edit] History

| This article needs additional citations for verification. Please help improve this article by adding reliable references (ideally, using inline citations). Unsourced material may be challenged and removed. (December 2008) |

During Roman times, the empire contracted out many of its services to private groups called publicani. Shares in publicani were called "socii" (for large cooperatives) and "particulae" which were analogous to today's Over-The-Counter shares of small companies. Though the records available for this time are incomplete, Edward Chancellor states in his book Devil Take the Hindmost that there is some evidence that a speculation in these shares became increasingly widespread and that perhaps the first ever speculative bubble in "stocks" occurred.[citation needed]

The first company to issue shares of stock after the Middle Ages was the Dutch East India Company in 1606. The innovation of joint ownership made a great deal of Europe's economic growth possible following the Middle Ages. The technique of pooling capital to finance the building of ships, for example, made the Netherlands a maritime superpower. Before adoption of the joint-stock corporation, an expensive venture such as the building of a merchant ship could be undertaken only by governments or by very wealthy individuals or families.

Economic historians find the Dutch stock market of the 1600s particularly interesting: there is clear documentation of the use of stock futures, stock options, short selling, the use of credit to purchase shares, a speculative bubble that crashed in 1695, and a change in fashion that unfolded and reverted in time with the market (in this case it was headdresses instead of hemlines). Dr. Edward Stringham also noted that the uses of practices such as short selling continued to occur during this time despite the government passing laws against it. This is unusual because it shows individual parties fulfilling contracts that were not legally enforceable and where the parties involved could incur a loss. Stringham argues that this shows that contracts can be created and enforced without state sanction or, in this case, in spite of laws to the contrary.[4][5]

[edit] Shareholder

A shareholder (or stockholder) is an individual or company (including a corporation) that legally owns one or more shares of stock in a joint stock company. Companies listed at the stock market are expected to strive to enhance shareholder value.

Shareholders are granted special privileges depending on the class of stock, including the right to vote (usually one vote per share owned) on matters such as elections to the board of directors, the right to share in distributions of the company's income, the right to purchase new shares issued by the company, and the right to a company's assets during a liquidation of the company. However, shareholder's rights to a company's assets are subordinate to the rights of the company's creditors.

Shareholders are considered by some to be a partial subset of stakeholders, which may include anyone who has a direct or indirect equity interest in the business entity or someone with even a non-pecuniary interest in a non-profit organization. Thus it might be common to call volunteer contributors to an association stakeholders, even though they are not shareholders.

Although directors and officers of a company are bound by fiduciary duties to act in the best interest of the shareholders, the shareholders themselves normally do not have such duties towards each other.

However, in a few unusual cases, some courts have been willing to imply such a duty between shareholders. For example, in California, USA, majority shareholders of closely held corporations have a duty to not destroy the value of the shares held by minority shareholders.[6][7]

The largest shareholders (in terms of percentages of companies owned) are often mutual funds, and especially passively managed exchange-traded funds.

[edit] Application

The owners of a company may want additional capital to invest in new projects within the company. They may also simply wish to reduce their holding, freeing up capital for their own private use.

By selling shares they can sell part or all of the company to many part-owners. The purchase of one share entitles the owner of that share to literally share in the ownership of the company, a fraction of the decision-making power, and potentially a fraction of the profits, which the company may issue as dividends.

In the common case of a publicly traded corporation, where there may be thousands of shareholders, it is impractical to have all of them making the daily decisions required to run a company. Thus, the shareholders will use their shares as votes in the election of members of the board of directors of the company.

In a typical case, each share constitutes one vote. Corporations may, however, issue different classes of shares, which may have different voting rights. Owning the majority of the shares allows other shareholders to be out-voted - effective control rests with the majority shareholder (or shareholders acting in concert). In this way the original owners of the company often still have control of the company.

[edit] Shareholder rights

Although ownership of 50% of shares does result in 50% ownership of a company, it does not give the shareholder the right to use a company's building, equipment, materials, or other property. This is because the company is considered a legal person, thus it owns all its assets itself. This is important in areas such as insurance, which must be in the name of the company and not the main shareholder.

In most countries, including the United States, boards of directors and company managers have a fiduciary responsibility to run the company in the interests of its stockholders. Nonetheless, as Martin Whitman writes:

- ...it can safely be stated that there does not exist any publicly traded company where management works exclusively in the best interests of OPMI [Outside Passive Minority Investor] stockholders. Instead, there are both "communities of interest" and "conflicts of interest" between stockholders (principal) and management (agent). This conflict is referred to as the principal/agent problem. It would be naive to think that any management would forgo management compensation, and management entrenchment, just because some of these management privileges might be perceived as giving rise to a conflict of interest with OPMIs.[8]

Even though the board of directors runs the company, the shareholder has some impact on the company's policy, as the shareholders elect the board of directors. Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. So as long as the shareholders agree that the management (agent) are performing poorly they can elect a new board of directors which can then hire a new management team. In practice, however, genuinely contested board elections are rare. Board candidates are usually nominated by insiders or by the board of the directors themselves, and a considerable amount of stock is held and voted by insiders.

Owning shares does not mean responsibility for liabilities. If a company goes broke and has to default on loans, the shareholders are not liable in any way. However, all money obtained by converting assets into cash will be used to repay loans and other debts first, so that shareholders cannot receive any money unless and until creditors have been paid (most often the shareholders end up with nothing).

[edit] Means of financing

Financing a company through the sale of stock in a company is known as equity financing. Alternatively, debt financing (for example issuing bonds) can be done to avoid giving up shares of ownership of the company. Unofficial financing known as trade financing usually provides the major part of a company's working capital (day-to-day operational needs).

[edit] Trading

A stock exchange is an organization that provides a marketplace for either physical or virtual trading shares, bonds and warrants and other financial products where investors (represented by stock brokers) may buy and sell shares of a wide range of companies. A company will usually list its shares by meeting and maintaining the listing requirements of a particular stock exchange. In the United States, through the inter-market quotation system, stocks listed on one exchange can also be bought or sold on several other exchanges, including relatively new so-called ECNs (Electronic Communication Networks like Archipelago or Instinet).

In the USA stocks used to be broadly grouped into NYSE-listed and NASDAQ-listed stocks. Until a few years ago there was a law that NYSE listed stocks were not allowed to be listed on the NASDAQ or vice versa.

Many large non-U.S companies choose to list on a U.S. exchange as well as an exchange in their home country in order to broaden their investor base. These companies have then to ship a certain number of shares to a bank in the US (a certain percentage of their principal) and put it in the safe of the bank. Then the bank where they deposited the shares can issue a certain number of so-called American Depositary Shares, short ADS (singular). If someone buys now a certain number of ADSs the bank where the shares are deposited issues an American Depository Receipt (ADR) for the buyer of the ADSs.

Likewise, many large U.S. companies list themselves at foreign exchanges to raise capital abroad.

[edit] Arbitrage trading

Although it makes sense for some companies to raise capital by offering stock on more than one exchange, a keen investor with access to information about such discrepancies could invest in expectation of their eventual convergence, known as an arbitrage trade. In today's era of electronic trading, these discrepancies, if they exist, are both shorter-lived and more quickly acted upon. As such, arbitrage opportunities disappear quickly due to the efficient nature of the market.

[edit] Buying

There are various methods of buying and financing stocks. The most common means is through a stock broker. Whether they are a full service or discount broker, they arrange the transfer of stock from a seller to a buyer. Most trades are actually done through brokers listed with a stock exchange, such as the New York Stock Exchange.

There are many different stock brokers from which to choose, such as full service brokers or discount brokers. The full service brokers usually charge more per trade, but give investment advice or more personal service; the discount brokers offer little or no investment advice but charge less for trades. Another type of broker would be a bank or credit union that may have a deal set up with either a full service or discount broker.

There are other ways of buying stock besides through a broker. One way is directly from the company itself. If at least one share is owned, most companies will allow the purchase of shares directly from the company through their investor relations departments. However, the initial share of stock in the company will have to be obtained through a regular stock broker. Another way to buy stock in companies is through Direct Public Offerings which are usually sold by the company itself. A direct public offering is an initial public offering in which the stock is purchased directly from the company, usually without the aid of brokers.

When it comes to financing a purchase of stocks there are two ways: purchasing stock with money that is currently in the buyer's ownership, or by buying stock on margin. Buying stock on margin means buying stock with money borrowed against the stocks in the same account. These stocks, or collateral, guarantee that the buyer can repay the loan; otherwise, the stockbroker has the right to sell the stock (collateral) to repay the borrowed money. He can sell if the share price drops below the margin requirement, at least 50% of the value of the stocks in the account. Buying on margin works the same way as borrowing money to buy a car or a house, using the car or house as collateral. Moreover, borrowing is not free; the broker usually charges 8-10% interest.

[edit] Selling

Selling stock is procedurally similar to buying stock. Generally, the investor wants to buy low and sell high, if not in that order (short selling); although a number of reasons may induce an investor to sell at a loss, e.g., to avoid further loss.

As with buying a stock, there is a transaction fee for the broker's efforts in arranging the transfer of stock from a seller to a buyer. This fee can be high or low depending on which type of brokerage, full service or discount, handles the transaction.

After the transaction has been made, the seller is then entitled to all of the money. An important part of selling is keeping track of the earnings. Importantly, on selling the stock, in jurisdictions that have them, capital gains taxes will have to be paid on the additional proceeds, if any, that are in excess of the cost basis.

[edit] Stock price fluctuations

The price of a stock fluctuates fundamentally due to the theory of supply and demand. Like all commodities in the market, the price of a stock is directly proportional to the demand. However, there are many factors on the basis of which the demand for a particular stock may increase or decrease. These factors are studied using methods of fundamental analysis and technical analysis to predict the changes in the stock price. A recent study shows that customer satisfaction, as measured by the American Customer Satisfaction Index (ACSI), is significantly correlated to the stock market value. Stock price is also changed based on the forecast for the company and whether their profits are expected to increase or decrease.

[edit] See also

- Arrangements between railroads

- Boiler room

- Bucket shop

- Buying in

- Concentrated stock

- Direct Registration System

- Equity investment

- GICS industry classification scheme

- Golden share

- House stock

- Insider trading

- Naked short selling

- Penny stock

- Restricted stock

- Scripophily

- Short selling

- Stock and flow

- Stock dilution

- Stock exchange

- Stock investor

- Stock market

- Stock options

- Stock valuation

- Stub (stock)

- Category:Money managers

- Voting interest

[edit] Notes

- ^ a b "Stock Basics", Investor Guide.com.

- ^ a b Zvi Bodie, Alex Kane, Alan J. Marcus, Investments, 7th Ed., p. 26–53.

- ^ Black Scholes Calculator

- ^ http://www.sjsu.edu/depts/economics/faculty/stringham/docs/stringham-amsterdam.pdf

- ^ "Devil the Hindmost" by Edward Chancellor.

- ^ Jones v. H. F. Ahmanson & Co., 1 Cal. 3d)

- ^ Jones v. H.F. Ahmanson & Co. (1969) 1 C3d 93

- ^ Whitman, 2004, 5

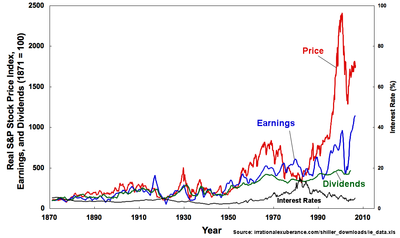

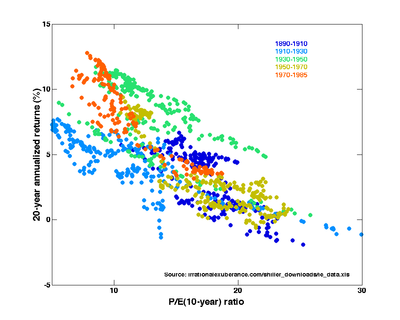

- ^ a b c Shiller, Robert (2005). Irrational Exuberance (2d ed.). Princeton University Press. ISBN 0-691-12335-7.

[edit] External links

- Stock exchanges at the Open Directory Project

- Stocks investing at the Open Directory Project

- Stock Market Terminology

- Stock Market Trivia: History of Stocks

- Stock Basics Tutorial

- The oldest share in the world, issued by the Dutch East India Company, VOC, 1606.

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||||