McCulloch v. Maryland

From Wikipedia, the free encyclopedia

| McCulloch v. Maryland | ||||||

|

||||||

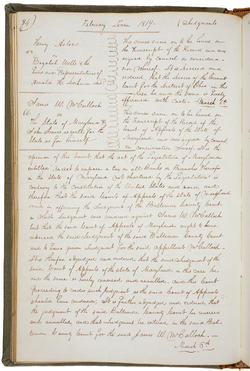

| Argued February 22, 1819 Decided March 6, 1819 |

||||||

|---|---|---|---|---|---|---|

| Full case name |

James McCulloch v. The State of Maryland, John James

|

|||||

| Citations | 17 U.S. 316 (more) 17 U.S. (4 Wheat.) 316; 4 L. Ed. 579; 1819 U.S. LEXIS 320; 4 A.F.T.R. (P-H) 4491; 4 Wheat. 316; 42 Cont. Cas. Fed. (CCH) P77,296 |

|||||

| Prior history | Judgment for John James, Baltimore County Court; affirmed, Maryland Court of Appeals | |||||

| Subsequent history | None | |||||

| Holding | ||||||

| Although the Constitution does not specifically give Congress the power to establish a bank, it does delegate the ability to tax and spend, and a bank is a proper and suitable instrument to assist the operations of the government in the collection and disbursement of the revenue. Because federal laws have supremacy over state laws, Maryland had no power to interfere with the bank's operation by taxing it. Maryland Court of Appeals reversed. | ||||||

| Court membership | ||||||

|

||||||

| Case opinions | ||||||

| Majority | Marshall, joined by unanimous | |||||

| Laws applied | ||||||

| U.S. Const. art. I, § 8, cl. 1, 18 | ||||||

McCulloch v. Maryland, 17 U.S. 316 (1819), was a landmark decision by the Supreme Court of the United States. The state of Maryland had attempted to impede operation of a branch of the Second Bank of the United States by imposing a tax on all notes of banks not chartered in Maryland. Though the law, by its language, was generally applicable, the U.S. Bank was the only out-of-state bank then existing in Maryland, and the law is generally recognized as having specifically targeted the U.S. Bank. The Court invoked the Necessary and Proper Clause in the Constitution, which allowed the Federal government to pass laws not expressly provided for in the Constitution's list of express powers as long as those laws are in useful furtherance of the express powers.

This fundamental case established the following two principles:

- The Constitution grants to Congress implied powers for implementing the Constitution's express powers, in order to create a functional national government.

- State action may not impede valid constitutional exercises of power by the Federal government.

The opinion was written by Chief Justice John Marshall.

Contents |

[edit] Background

On April 10, 1816, the Congress of the United States passed an act entitled "An Act to Incorporate the Subscribers to the Bank of the United States" which provided for the incorporation of the Second Bank of the United States. The Bank first went into full operation in Philadelphia, Pennsylvania. In 1817 the Bank opened a branch in Baltimore, Maryland and transacted and carried on business as a branch of the Bank of the United States by issuing bank notes, discounting promissory notes, and performing other operations usual and customary for banks to do and perform. Both sides of the litigation admitted that the President, directors and company of the Bank had no authority to establish the Baltimore branch, or office of discount and deposit, other than the fact that Maryland had adopted the Constitution of the United States.

On February 11, 1818, the General Assembly of Maryland passed an act entitled, "an act to impose a tax on all banks, or branches thereof, in the State of Maryland, not chartered by the legislature":

Be it enacted by the General Assembly of Maryland that if any bank has established or shall, without authority from the State first had and obtained establish any branch, office of discount and deposit, or office of pay and receipt in any part of this State, it shall not be lawful for the said branch, office of discount and deposit, or office of pay and receipt to issue notes, in any manner, of any other denomination than five, ten, twenty, fifty, one hundred, five hundred and one thousand dollars, and no note shall be issued except upon stamped paper of the following denominations; that is to say, every five dollar note shall be upon a stamp of ten cents; every ten dollar note, upon a stamp of twenty cents; every twenty dollar note, upon a stamp of thirty cents; every fifty dollar note, upon a stamp of fifty cents; every one hundred dollar note, upon a stamp of one dollar; every five hundred dollar note, upon a stamp of ten dollars; and every thousand dollar note, upon a stamp of twenty dollars; which paper shall be furnished by the Treasurer of the Western Shore, under the direction of the Governor and Council, to be paid for upon delivery; provided always that any institution of the above description may relieve itself from the operation of the provisions aforesaid by paying annually, in advance, to the Treasurer of the Western Shore, for the use of State, the sum of $15,000.

And be it enacted that the President, cashier, each of the directors and officers of every institution established or to be established as aforesaid, offending against the provisions aforesaid shall forfeit a sum of $500 for each and every offence, and every person having any agency in circulating any note aforesaid, not stamped as aforesaid directed, shall forfeit a sum not exceeding $100, every penalty aforesaid to be recovered by indictment or action of debt in the county court of the county where the offence shall be committed, one-half to the informer and the other half to the use of the State...

James McCulloch, head of the Baltimore Branch of the Second Bank of the United States, refused to pay the tax. The lawsuit was filed by John James, an informer who sought to collect one half of the fine as provided for by the statute. The case was appealed to the Maryland Court of Appeals where the state of Maryland argued that "the Constitution is silent on the subject of banks." It was Maryland's contention that because the Constitution did not specifically state that the Federal Government was authorized to charter a bank, the Bank of the United States was unconstitutional. The court upheld Maryland. The case was then appealed to the Supreme Court.

[edit] Supreme Court decision

The court determined that Congress had the power to charter the bank. Chief Justice Marshall supported this conclusion with three main arguments.

1. The Court argued that the Constitution was a social contract created by the people via the Constitutional Convention. The government proceeds from the people and binds the state sovereignties. Therefore, the federal government is supreme, based on the consent of the people. Marshall declares the federal government’s overarching supremacy in his statement:

| “ | If any one proposition could command the universal assent of mankind, we might expect it would be this– that the government of the Union, though limited in its power, is supreme within its sphere of action. | ” |

2. Congress is bound to act under explicit or implied powers of the Constitution. Pragmatically, if all of the means for implementing the explicit powers were listed, then we would not be able to understand or embrace the document; it would not be possible to write them all down in a brief document. Although the term "bank" is not included, there are express powers in the Taxing and Spending Clause. Although not explicitly stated, Congress has the implied power to create the bank in order to implement the express powers.

3. Marshall supported the Court's opinion textually using the Necessary and Proper Clause, which permits Congress to seek an objective that is within the enumerated powers as long as it is rationally related to the objective and not forbidden by the Constitution. Marshall rejected Maryland's narrow interpretation of the clause, because many of the enumerated powers would be useless. Marshall noted that the Necessary and Proper Clause is listed within the powers of Congress, not the limitations.

For those reasons, the word "necessary" does not refer to the only way of doing something, but rather applies to various procedures for implementing all constitutionally established powers. Marshall wrote:

| “ | Let the end be legitimate, let it be within the scope of the constitution, and all means which are appropriate, which are plainly adapted to that end, which are not prohibited, but consist with the letter and spirit of the constitution, are constitutional. | ” |

This principle had been established many years earlier by Alexander Hamilton:[1]

| “ | [A] criterion of what is constitutional, and of what is not so.... is the end, to which the measure relates as a mean. If the end be clearly comprehended within any of the specified powers, and if the measure have an obvious relation to that end, and is not forbidden by any particular provision of the Constitution, it may safely be deemed to come within the compass of the national authority. There is also this further criterion which may materially assist the decision: Does the proposed measure abridge a pre-existing right of any State, or of any individual? If it does not, there is a strong presumption in favour of its constitutionality.... | ” |

Chief Justice Marshall also determined that Maryland may not tax the bank without violating the Constitution. The Supremacy Clause dictates that State laws comply with the Constitution and yield when there is a conflict. Taking as undeniable the fact that "the power to tax involves the power to destroy", the court concluded that the Maryland tax could not be levied against the government. If states were allowed to continue their acts, they would destroy the institution created by federal government and oppose the principle of federal supremacy which originated in the text of the Constitution.

4. The Court held that Maryland violated the Constitution by taxing the bank, and therefore voided that tax. The opinion stated that Congress has implied powers that need to be related to the text of the Constitution, but need not be enumerated within the text. This case was a seminal moment in the formation of a balance between federalism, federal power, and states' powers.

Chief Justice Marshall also explained in this case that the Necessary and Proper Clause does not require that all federal laws be necessary and proper. Federal laws that are enacted directly pursuant to one of the express, enumerated powers need not comply with the Necessary and Proper Clause. As Marshall put it, this Clause "purport[s] to enlarge, not to diminish the powers vested in the government. It purports to be an additional power, not a restriction on those already granted.

[edit] Later history

McCulloch v. Maryland was cited in the first substantial constitutional case presented before the High Court of Australia in D'Emden v Pedder, which dealt with similar issues in the Australian Federation; while recognizing United States law as not binding on them, nevertheless determined that the McCulloch decision provided the best guideline for the relationship between the Commonwealth federal government and the Australian States owing to strong similarities between the American and Australian federations, and specifically cited Marshall's opinion in deciding the case.

[edit] See also

[edit] References

- Jean Edward Smith, John Marshall: Definer Of A Nation, New York: Henry Holt & Company, 1996.

- Jean Edward Smith, The Constitution And American Foreign Policy, St. Paul, MN: West Publishing Company, 1989.

- Karen O'Connor (professor), Larry J. Sabato, "American Government: Continuity and Change," New York, Pearson, 2006.

- Tushnet, Mark (2008). I dissent: Great Opposing Opinions in Landmark Supreme Court Cases. Boston: Beacon Press. pp. 17–30. ISBN 9780807000366.