Call option

From Wikipedia, the free encyclopedia

A call option is a financial contract between two parties, the buyer and the seller of this type of option. It is the option to buy shares of stock at a specified time in the future.[1]Often it is simply labeled a "call". The buyer of the option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument (the underlying instrument) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). The seller (or "writer") is obligated to sell the commodity or financial instrument should the buyer so decide. The buyer pays a fee (called a premium) for this right.

The buyer of a call option wants the price of the underlying instrument to rise in the future; the seller either expects that it will not, or is willing to give up some of the upside (profit) from a price rise in return for the premium (paid immediately) and retaining the opportunity to make a gain up to the strike price (see below for examples).

Call options are most profitable for the buyer when the underlying instrument is moving up, making the price of the underlying instrument closer to the strike price. The call buyer believes it's likely the price of the underlying asset will rise by the exercise date. The risk is limited to the premium. The profit for the buyer can be very large, and is limited by how high underlying's spot rises. When the price of the underlying instrument surpasses the strike price, the option is said to be "in the money".

The call writer does not believe the price of the underlying security is likely to rise. The writer sells the call to collect the premium. The total loss, for the call writer, can be very large indeed, and is only limited by how high the underlying's spot price rises.

The initial transaction in this context (buying/selling a call option) is not the supplying of a physical or financial asset (the underlying instrument). Rather it is the granting of the right to buy the underlying asset, in exchange for a fee - the option price or premium.

Exact specifications may differ depending on option style. A European call option allows the holder to exercise the option (i.e., to buy) only on the option expiration date. An American call option allows exercise at any time during the life of the option.

Call options can be purchased on many financial instruments other than stock in a corporation. Options can be purchased on futures on interest rates, for example (see interest rate cap), and on commodities like gold or crude oil. A tradeable call option should not be confused with either Incentive stock options or with a warrant. An incentive stock option, the option to buy stock in a particular company, is a right granted by a corporation to a particular person (typically executives) to purchase treasury stock. When an incentive stock option is exercised, new shares are issued. Incentive stock options are not traded on the open market. In contrast, when a call option is exercised, the underlying asset is transferred from one owner to another.

[edit] Example of a call option on a stock

Buy a call: The buyer expects that the price may go up.

The buyer pays a premium that will never be refunded.

He has the right to exercise the option at the strike price,

meaning the buyer can choose to buy the stock at the strike

price. (If the price goes up enough, the buyer then pays

the strike price to actually purchase the stock. After

purchase, he can then choose to hold the stock, or sell

it to realize his profit.)

Write a call: The writer receives the premium.

If the buyer decides to exercise the option, then

the writer has to sell the stock at the strike price.

If the buyer does not exercise the option, then

the writer profits the premium.

- 'Trader A' (Call Buyer) purchases a Call contract to buy 100 shares of XYZ Corp from 'Trader B' (Call Writer) at $50/share. The current price is $45/share, and 'Trader A' pays a premium of $5/share. If the share price of XYZ stock rises to $60/share right before expiration, then 'Trader A' can exercise the call by buying 100 shares for $5,000 from 'Trader B' and sell them at $6,000 in the stock market.

Trader A's total earnings (S) can be calculated at $500. Sale of 100 stock at $60 = $6,000 (P) Amount paid to 'Trader B' for the 100 stock bought at strike price of $50 = $5,000 (Q) Call Option premium paid to Trader B for buying the contract of 100 shares @ $5/share, excluding commissions = $500 (R) S=P-(Q+R)=$6,000−($5,000+$500)=$500'

- If, however, the price of XYZ drops to $40/share below the strike price, then 'Trader A' would not exercise the option. (Why buy a stock from 'Trader B' at 50, the strike price, when it can be bought at $40 in the stock market?) Trader A's option would be worthless and the whole investment, the fee (premium) for the option contract, $500 (5/share, 100 shares per contract). Trader A's total loss is limited to the cost of the call premium plus the sales commission to buy it.

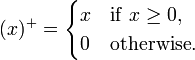

This example illustrates that a call option has positive monetary value when the underlying instrument has a spot price (S) above the strike price (K). Since the option will not be exercised unless it is "in-the-money", the payoff for a call option is

- max[(S − K);0] or, more formally, (S − K) +

- where :

Prior to exercise, the option value, and therefore price, varies with the underlying price and with time. The call price must reflect the "likelihood" or chance of the option "finishing in-the-money". The price should thus be higher with more time to expire (except in cases when a significant dividend is present) and with a more volatile underlying instrument. The science of determining this value is the central tenet of financial mathematics. The most common method is to use the Black-Scholes formula. Whatever the formula used, the buyer and seller must agree on the initial value (the premium), otherwise the exchange (buy/sell) of the option will not take place.

[edit] Options

- Binary option

- Bond option

- Credit default option

- Exotic interest rate option

- Foreign exchange option

- Interest rate cap and floor

- Options on futures

- Stock option

- Swaption

- Warrant

[edit] See also

[edit] References

|

|

||||||||||||||||||||||||||||||||||