The Wealth of Nations

From Wikipedia, the free encyclopedia

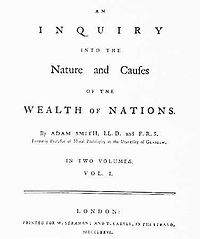

| The Wealth of Nations | |

|

|

| Author | Adam Smith |

|---|---|

| Country | United Kingdom |

| Genre(s) | Economics |

| Publisher | W. Strahan and T. Cadell, London |

| Publication date | 1776 |

An Inquiry into the Nature and Causes of the Wealth of Nations is the magnum opus of the Scottish economist Adam Smith. It is a clearly written account of economics at the dawn of the Industrial Revolution, as well as a rhetorical piece written for the generally educated individual of the 18th century - advocating a free market economy as more productive and more beneficial to society.

The work is credited as a watershed in history and economics due to its comprehensive, largely accurate characterization of economic mechanisms that survive in modern economics; and also for its effective use of rhetorical technique, including structuring the work to contrast real world examples of free and fettered markets.

Contents |

[edit] Themes

| This section does not cite any references or sources. Please help improve this article by adding citations to reliable sources (ideally, using inline citations). Unsourced material may be challenged and removed. (November 2008) |

[edit] The invisible hand

A phrase often quoted and alluded to, it conveys the unintentional benefits stemming from individuals' pursuit of their own wants and needs. An example from the earlier chapters: The Butcher, the Baker, and the Brewer provide goods and services to each other out of self-interest; the unplanned result of this division of labor is a better standard of living for all three.

There are two important features of Smith's concept of the "invisible hand". First, Smith was not advocating a social policy (that people should act in their own self interest), but rather was describing an observed economic reality (that people do act in their own interest). Second, Smith was not claiming that all self-interest has beneficial effects on the community. He did not argue that self-interest is always good; he merely argued against the view that self-interest is necessarily bad.

On another level, though, the "invisible hand" refers to the ability of the market to correct for seemingly disastrous situations with no intervention on the part of government or other organizations (although Smith did not, himself, use the term with this meaning in mind). For example, Smith says, if a product shortage were to occur, that product's price in the market would rise, creating incentive for its production and a reduction in its consumption, eventually curing the shortage. The increased competition among manufacturers and increased supply would also lower the price of the product to its production cost plus a small profit, the "natural price." Smith believed that while human motives are ultimately out of self interest, the net effect in the free market would tend to benefit society as a whole. This was later adopted as a universal principle by the laissez-faire economists of the 19th century.

Smith used the phrase "invisible hand" only once in his work, in chapter two of the fourth book, "Of Restraints upon the Importation from Foreign Countries." His usage was in the context of a problem, in Smith's view, posed by free and open markets among nations. If markets were free and open, the question arose how would a nation (such as Great Britain, the nation Smith cared about) keep its capitalists from moving their capital out of the nation and into other countries where labor could be bought for cheaper. The answer, Smith says, is that they will act with a view toward their own particular nationalistic interests which happen to correspond with the "public interest" at home. In this way, by "preferring the support of domestic to that of foreign industry," the capitalist will in a sense be "led by an invisible hand to promote an end which was no part of his intention." Later writers[who?], both supporters and detractors, repeated this phrase far out of proportion to Smith's own usage and also out of context, with an entirely new meaning not intended by Smith.[citation needed]

[edit] Meritocracy

Meritocracy is an important factor in the work; Smith emphasizes the advancement that one can take based on their will to better themselves. People would want to do things with a strong mindset without the interference of the outside norms. Smith also points out the fact that the outside forces lead to infancy in the division of labor, therefore slowing the economic growth. Because the idea of self-improvement is very strong, meritocracy efficiently moves the outcomes of the division of labor, ultimately leading to more efficiency in the economy.

[edit] History

The Wealth of Nations was first published on March 9, 1776, during the Age of Enlightenment. It influenced not only authors and economists, but governments and organizations. For example, Alexander Hamilton was influenced in part by The Wealth of Nations to write his Report on Manufactures, in which he argued against many of Smith's policies. Interestingly, Hamilton based much of this report on the ideas of Jean-Baptiste Colbert, and it was, in part, to Colbert's ideas that Smith wished to respond with The Wealth of Nations.

Many other authors were influenced by the book and used it as a starting point in their own work, including Jean-Baptiste Say, David Ricardo, Thomas Malthus and, later, Karl Marx and Ludwig von Mises. The Russian national poet Aleksandr Pushkin refers to The Wealth of Nations in his 1833 verse-novel Eugene Onegin.

Irrespective of historical influence, however, The Wealth of Nations represented a clear leap forward in the field of economics, similar to Sir Isaac Newton's Principia Mathematica for physics or Antoine Lavoisier's Traité Élémentaire de Chimie for chemistry.

[edit] Publishing history

Five editions of The Wealth of Nations were published during Smith's lifetime: in 1776, 1778, 1784, 1786, and 1789. Numerous editions appeared after Smith's death in 1790. To better understand the evolution of the work under Smith's hand, a team led by Edwin Cannan collated the first five editions. The differences were published along with an edited fifth edition in 1904.[1] They found minor but numerous differences (including the addition of many footnotes) between the first and the second editions, both of which were published in two volumes. The differences between the second and third editions, however, are major: In 1784, Smith annexed these first two editions with the publication of Additions and Corrections to the First and Second Editions of Dr. Adam Smith’s Inquiry into the Nature and Causes of the Wealth of Nations, and he also had published the now three volume third edition of the Wealth of Nations which incorporated Additions and Corrections and, for the first time, an index. Among other things, the Additions and Corrections included entirely new sections. The fourth edition published in 1786 had only slight differences with the third edition, and Smith himself says in the Advertisement at the beginning of the book, "I have made no alterations of any kind." Finally, Cannan notes only trivial differences between the fourth and fifth editions — a set of misprints being removed from the fourth, and a different set of misprints being introduced.

[edit] Anachronisms and terminology

Some commentary on the work suffers from anachronism - imposition of modern context and political contests on a two hundred and fifty year old work.

The book is written in the English of the late 1700s, so there are some points to consider:

- The term economics was not yet in use.

- The term capitalism was not yet in use. Smith talks about a "system of perfect liberty" or "system of natural liberty".

- To a certain extent, some form of Feudalism was still dominant in parts of Europe.

- The term corporation, as in feudal corporations, referred to a body that regulated and, in Smith's portrayal, limited participation in a skilled trade.

[edit] Contents

[edit] Book I: Of the Causes of Improvement...

Of the Division of Labour: Smith states that "the greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgment with which it is anywhere directed, or applied, seem to have been the effects of the division of labour." To illustrate this, he describes the extensive division of labour within the "trifling" industry of pin manufacture, along with the astounding resultant productivity, and labourers' dexterity; then levers this as an introductory microcosm of the greater, yet less obvious division of labour in the broader economy. The advantages of this division were likely the driving force behind diversification of the trades and industry, and this diversification was greatest for nations with more industry and improvement. Agriculture is differentiated from industry for its comparative lack of division of labour, and the attendant lack of improved productivity; hence, while poor nations could not compete with rich nations in manufactures, they could compete in agriculture.

Smith lists three causes, arising from division, of improved productivity:

- the labourer's dexterity - due to specializing, year-round, in a specific task

- time not wasted passing from one task to the next - as in agriculture - as well as the more consistent and focused effort when working in just one area

- the machines and tools that have evolved in conjunction with increasingly specialised labour.

Of the Principle which gives Occasion to the Division of Labour: Chapter 2 illustrates the growth in division of labour. Smith hypothesizes that early societies benefited from specialization in a natural and spontaneous way - that an individual may focus on hunting while an other focuses on manufacture (an early trade).

That the Division of Labour is Limited by the Extent of the Market: Chapter 3 deals with limitations on division of labour. Smith illustrates with real world examples of how the extent of market determines the level of division of labour and the resulting productivity improvements; it is the extent of the market that determines the degree to which division of labour can survive - in a limited market, the liability of specialization out weigh the benefits of greater productivity.

Of the Origin and Use of Money: When money was first invented, it was not well regulated, which made agriculture and commodities very difficult between individual owners.

Of the Real and Nominal Price of Commodities, or of their Price in Labour, and their Price in Money: Smith begins by setting out the source of a commodity's value. He states,

"Every man is rich or poor according to the degree in which he can afford to enjoy the necessaries, conveniencies, and amusements of human life. But after the division of labour has once thoroughly taken place, it is but a very small part of these with which a man's own labour can supply him. The far greater part of them he must derive from the labour of other people, and he must be rich or poor according to the quantity of that labour which he can command, or which he can afford to purchase. The value of any commodity, therefore, to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities. The real price of every thing, what every thing really costs to the man who wants to acquire it, is the toil and trouble of acquiring it."[2]

This is known as the labour theory of value, a defining feature of classical political economy. Smith then distinguishes between the nominal value of a commodity (in money denomination) and its real value in the labour required to purchase it. According to Smith, while the nominal value of a commodity is subject to fluctuation, this does not change its real value, because the amount of labour required to produce it and bring it to the market remains constant.

For example, the price of a commodity redeemable in silver may be 1:1, as the amount of labour required to produce that commodity is the same as the amount of labour required to retrieve one piece of silver. However, with the discovery of new silver mines in North America, a surge in the supply of silver in the economy may bring the nominal price of the commodity in silver to 1:2. Yet this does not affect the commodity's real value, because the abundance of silver in the newly discovered mines does not suppose a lesser degree of labour required to retrieve them, but simply a greater availability of silver in the market. It is this greater availability that accounts for the deflation of the price; while the commodity is worth just as much labour now as it was before, it will not command as much power in the economy as before. However, if the price were to rise to 1:2 as a result of technological improvements in the manufacture or transport of the commodity, this would constitute a decline in its real value, because less labour is necessary to produce and market it.

Of the Component Parts of the Price of Commodities: Smith argues that the price of any product reflects wages, rent of land and "profit of stock," which compensates the capitalist for risking his resources.

Of the Natural and Market Price of Commodities:

"When the quantity of any commodity which is brought to market falls short of the effectual demand, all those who are willing to pay... cannot be supplied with the quantity which they want... Some of them will be willing to give more. A competition will begin among them, and the market price will rise... When the quantity brought to market exceeds the effectual demand, it cannot be all sold to those who are willing to pay the whole value of the rent, wages and profit, which must be paid in order to bring it thither... The market price will sink..."[3]

To paraphrase Smith, and the first part of this Chapter, when demand exceeds supply, the price goes up. When the supply exceeds demand, the price goes down.

He then goes on to comment on the different avenues that people can take to generate a larger profit then normal. Some of those include: finding a commodity that few others have that allows for a high profit, and being able to keep that secret; Finding a way to produce a unique commodity (The dyer who discovers a unique dye). He also states that the former usually has a short lifespan of high profitability, and the latter has a longer. He also notes that a monopoly is essentially the same as the dyers trade secret, and can thus lead to high profitability for a long time by keeping the supply below the effectual demand.

"A monopoly granted either to an individual or to a trading company has the same effect as a secret in trade or manufactures. The monopolists, by keeping the market constantly understocked, by never fully supplying the effectual demand, sell their commodities much above the natural price, and raise their emoluments, whether they consist in wages or profit, greatly above their natural rate. The price of monopoly is upon every occasion the highest which can be got. The natural price, or the price of free competition, on the contrary, is the lowest which can be taken, not upon every occasion, indeed, but for any considerable time together. The one is upon every occasion the highest which can be squeezed out of the buyers, or which, it is supposed, they will consent to give: the other is the lowest which the sellers can commonly afford to take, and at the same time continue their business."[4]

Of the Wages of Labour: In this section, Smith describes how the wages of labour are dictated primarily by the competition among labourers and masters. When labourers bid against one another for limited opportunities for employment, the wages of labour collectively fall, whereas when employers compete against one another for limited supplies of labour, the wages of labour collectively rise. However, this process of competition is often circumvented by combinations among labourers and among masters. When labourers combine and no longer bid against one another, their wages rise, whereas when masters combine, wages fall. In Smith's day, it should be noted, organized labour was dealt with very harshly by the law.

In societies where the amount of labour is in abundance to the amount of revenue which may be used to pay for waged labour, the competition among workers is greater than the competition among masters, and wages fall; inversely, where excess revenue is in abundance, the wages of labour rise. Smith argues that, therefore, the wages of labour only rise as a result of greater revenue disposed to pay for labour. Labour is the same as any other commodity in this respect thought Smith,

"the demand for men, like that for any other commodity, necessarily regulates the production of men; quickens it when it goes on too slowly, and stops it when it advances too fast. It is this demand which regulates and determines the state of propagation in all the different countries of the world, in North America, in Europe, and in China; which renders it rapidly progressive in the first, slow and gradual in the second, and altogether stationary in the last."[5]

However, the amount of revenue must be increasing constantly in proportion to the amount of labour in order for wages to remain high. Smith illustrates this by juxtaposing England with the North American colonies. In England, there is certainly a greater amount of revenue than in the colonies; however, the wages of labour are lower, because more workers would flock to new employment opportunities to which the large amount of revenue gives occasion, eventually competing against each other as much as they did before. By contrast, as capital continues to be introduced to the colonial economies at least at the same rate that population increases to "fill out" this excess capital, the wages of labour there are kept much higher than in England.

Smith was highly concerned about the problems of poverty. He writes,

"poverty, though it does not prevent the generation, is extremely unfavourable to the rearing of children... It is not uncommon... in the Highlands of Scotland for a mother who has borne twenty children not to have two alive... In some places one half the children born die before they are four years of age; in many places before they are seven; and in almost all places before they are nine or ten. This great mortality, however, will every where be found chiefly among the children of the common people, who cannot afford to tend them with the same care as those of better station."[6]

the only way to decide whether a man is rich or poor only depends on the amount of labour he is able to afford to purchase. "Labour is the real exchange for commodities".

Smith also describes the relation of cheap years and the production of manufactures versus the production in dear years. He argues that while some examples such as the linen production in France shows a correlation, another example in Scotland shows the opposite. He concludes that there are too many variables to make any statement about this.

Of the Profits of Stock: In this chapter, Smith uses interest rates as an indicator of the profits of stock. This is because interest can only be paid with the profits of stock, and so creditors will be able to raise rates in proportion to the increase or decrease of the profits of their debtors.

Smith argues that the profits of stock are inversely proportional to the wages of labor, because as more money is spent compensating labor, there is less remaining for personal profit. It follows that, in societies where competition among laborers is greatest relative to competition among employers, profits will be much higher. Smith illustrates this by comparing interest rates in England and Scotland. In England, government laws against usury had kept maximum interest rates very low, but even the maximum rate was believed to be higher than the rate at which money was usually lended. In Scotland, however, interest rates are much higher. This is the result of a greater proportion of capitalists in England, which offsets some competition among laborers and raises wages.

However, Smith notes that, curiously, interest rates in the colonies are also remarkably high (recall that, in the previous chapter, Smith described how wages in the colonies are higher than in England). Smith attributes this to the fact that, when an empire takes control of a colony, prices for a huge abundance of land and resources are extremely cheap. This allows capitalists to increase his profit, but simultaneously draws many capitalists to the colonies, increasing the wages of labor. As this is done, however, the profits of stock in the mother country rise (or at least cease to fall), as much of it has already flocked offshore.

Of Wages and Profit in the Different Employments of Labour and Stock: Smith repeatedly attacks groups of politically aligned individuals who attempt to use their collective influence to manipulate the government into doing their bidding. At the time, these were referred to as "factions," but are now more commonly called "special interests," a term which can comprise international bankers, corporate conglomerations, outright oligopolies, trade unions and other groups. Indeed, Smith had a particular distrust of the tradesman class. He felt that the members of this class, especially acting together within the guilds they want to form, could constitute a power block and manipulate the state into regulating for special interests against the general interest:

"People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary."[7]

Smith also argues against government subsidies of certain trades, because this will draw many more people to the trade than what would otherwise be normal, collectively lowering their wages.

Chapter 10, part ii, motivates an understanding of the idea of feudalism.

Of the Rent of the Land: Rent, considered as the price paid for the use of land, is naturally the highest which the tenant can afford to pay in the actual circumstances of the land. In adjusting the terms of the lease, the landlord endeavours to leave him no greater share of the produce than what is sufficient to keep up the stock from which he furnishes the seed, pays the labour, and purchases and maintains the cattle and other instruments of husbandry, together with the ordinary profits of farming stock in the neighbourhood. This is evidently the smallest share with which the tenant can content himself without being a loser, and the landlord seldom means to leave him any more. Whatever part of the produce, or, what is the same thing, whatever part of its price, is over and above this share, he naturally endeavours to reserve to himself as the rent of his land, which is evidently the highest the tenant can afford to pay in the actual circumstances of the land. Sometimes, indeed, the liberality, more frequently the ignorance, of the landlord, makes him accept of somewhat less than this portion; and sometimes too, though more rarely, the ignorance of the tenant makes him undertake to pay somewhat more, or to content himself with somewhat less, than the ordinary profits of farming stock in the neighbourhood. This portion, however, may still be considered as the natural rent of land, or the rent for which it is naturally meant that land should for the most part be let.

[edit] Book II: Of the Nature, Accumulation, and Employment of Stock

Of the Division of Stock: When the stock which a man possesses is no more than sufficient to maintain him for a few days or a few weeks, he seldom thinks of deriving any revenue from it. He consumes it as sparingly as he can, and endeavours by his labour to acquire something which may supply its place before it be consumed altogether. His revenue is, in this case, derived from his labour only. This is the state of the greater part of the labouring poor in all countries.

II.1.1

But when he possesses stock sufficient to maintain him for months or years, he naturally endeavours to derive a revenue from the greater part of it; reserving only so much for his immediate consumption as may maintain him till this revenue begins to come in. His whole stock, therefore, is distinguished into two parts. That part which, he expects, is to afford him this revenue, is called his capital.

Of Money Considered as a particular Branch of the General Stock of the Society...: From references of the first book, that the price of the greater part of commodities resolves itself into three parts, of which one pays the wages of the labour, another the profits of the stock, and a third the rent of the land which had been employed in producing and bringing them to market: that there are, indeed, some commodities of which the price is made up of two of those parts only, the wages of labour, and the profits of stock: and a very few in which it consists altogether in one, the wages of labour: but that the price of every commodity necessarily resolves itself into some one, or other, or all of these three parts; every part of it which goes neither to rent nor to wages, being necessarily profit to somebody.

Of the Accumulation of Capital, or of Productive and Unproductive Labour: There is one sort of labour which adds to the value of the subject upon which it is bestowed: there is another which has no such effect. The former, as it produces a value, may be called productive; the latter, unproductive labour. Thus the labour of a manufacturer adds, generally, to the value of the materials which he works upon, that of his own maintenance, and of his master's profit. The labour of a menial servant, on the contrary, adds to the value of nothing.

Of Stock Lent at Interest: The stock which is lent at interest is always considered as a capital by the lender. He expects that in due time it is to be restored to him, and that in the meantime the borrower is to pay him a certain annual rent for the use of it. The borrower may use it either as a capital, or as a stock reserved for immediate consumption. If he uses it as a capital, he employs it in the maintenance of productive labourers, who reproduce the value with a profit. He can, in this case, both restore the capital and pay the interest without alienating or encroaching upon any other source of revenue. If he uses it as a stock reserved for immediate consumption, he acts the part of a prodigal, and dissipates in the maintenance of the idle what was destined for the support of the industrious. He can, in this case, neither restore the capital nor pay the interest without either alienating or encroaching upon some other source of revenue, such as the property or the rent of land.

The stock which is lent at interest is, no doubt, occasionally employed in both these ways, but in the former much more frequently than in the latter.

[edit] Book III: Of the different Progress of Opulence in different Nations

Of the Natural Progress of Opulence: The great commerce of every civilized society is that carried on between the inhabitants of the town and those of the country. It consists in the exchange of crude for manufactured produce, either immediately, or by the intervention of money, or of some sort of paper which represents money. The country supplies the town with the means of subsistence and the materials of manufacture. The town repays this supply by sending back a part of the manufactured produce to the inhabitants of the country. The town, in which there neither is nor can be any reproduction of substances, may very properly be said to gain its whole wealth and subsistence from the country. We must not, however, upon this account, imagine that the gain of the town is the loss of the country. The gains of both are mutual and reciprocal, and the division of labour is in this, as in all other cases, advantageous to all the different persons employed in the various occupations into which it is subdivided.

Of the Discouragement of Agriculture...: Chapter 2's long title is "Of the Discouragement of Agriculture in the Ancient State of Europe after the Fall of the Roman Empire". When the German and Scythian nations overran the western provinces of the Roman empire, the confusions which followed so great a revolution lasted for several centuries. The rapine and violence which the barbarians exercised against the ancient inhabitants interrupted the commerce between the towns and the country. The towns were deserted, and the country was left uncultivated, and the western provinces of Europe, which had enjoyed a considerable degree of opulence under the Roman empire, sunk into the lowest state of poverty and barbarism. During the continuance of those confusions, the chiefs and principal leaders of those nations acquired or usurped to themselves the greater part of the lands of those countries. A great part of them was uncultivated; but no part of them, whether cultivated or uncultivated, was left without a proprietor. All of them were engrossed, and the greater part by a few great proprietors.

This original engrossing of uncultivated lands, though a great, might have been but a transitory evil. They might soon have been divided again, and broke into small parcels either by succession or by alienation. The law of primogeniture hindered them from being divided by succession: the introduction of entails prevented their being broke into small parcels by alienation.

Of the Rise and Progress of Cities and Towns, after the Fall of the Roman Empire: The inhabitants of cities and towns were, after the fall of the Roman empire, not more favoured than those of the country. They consisted, indeed, of a very different order of people from the first inhabitants of the ancient republics of Greece and Italy. These last were composed chiefly of the proprietors of lands, among whom the public territory was originally divided, and who found it convenient to build their houses in the neighbourhood of one another, and to surround them with a wall, for the sake of common defence. After the fall of the Roman empire, on the contrary, the proprietors of land seem generally to have lived in fortified castles on their own estates, and in the midst of their own tenants and dependants. The towns were chiefly inhabited by tradesmen and mechanics, who seem in those days to have been of servile, or very nearly of servile condition. The privileges which we find granted by ancient charters to the inhabitants of some of the principal towns in Europe sufficiently show what they were before those grants. The people to whom it is granted as a privilege that they might give away their own daughters in marriage without the consent of their lord, that upon their death their own children, and not their lord, should succeed to their goods, and that they might dispose of their own effects by will, must, before those grants, have been either altogether or very nearly in the same state of villanage with the occupiers of land in the country

How the Commerce of the Towns Contributed to the Improvement of the Country: Smith often harshly criticised those who act purely out of self-interest and greed, and warns that, "[a]ll for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind." (Book 3, Chapter 4)

[edit] Book IV: Of Systems of political Economy

Smith vigorously attacked the antiquated government restrictions which he thought were hindering industrial expansion. In fact, he attacked most forms of government interference in the economic process, including tariffs, arguing that this creates inefficiency and high prices in the long run. It is believed that this theory influenced government legislation in later years, especially during the 19th century. (However this was not an anarchistic opposition to government. Smith advocated a Government that was active in sectors other than the economy: he advocated public education of poor adults; institutional systems that were not profitable for private industries; a judiciary; and a standing army.)

Of the Principle of the Commercial or Mercantile System: The book has sometimes been described as a critique of mercantilism and a synthesis of the emerging economic thinking of Smith's time. Specifically, The Wealth of Nations attacks, inter alia, two major tenets of mercantilism:

- The idea that protectionist tariffs serve the economic interests of a nation (or indeed any purpose whatsoever) and

- The idea that large reserves of gold bullion or other precious metals are necessary for a country's economic success. This critique of mercantilism was later used by David Ricardo when he laid out his Theory of Comparative Advantage.

Of Restraints upon the Importation...: Chapter 2's full title is "Of Restraints upon the Importation from Foreign Countries of such Goods as can be Produced at Home". The "Invisible Hand" is a frequently referenced theme from the book, although it is specifically mentioned only once.

"As every individual, therefore, endeavors as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it." (Book 4, Chapter 2)

Of the extraordinary Restraints...: Chapter 3's long title is "Of the extraordinary Restraints upon the Importation of Goods of almost all Kinds, from those Countries with which the Balance is supposed to be Disadvantageous".

Of Drawbacks: Merchants and manufacturers are not contented with the monopoly of the home market, but desire likewise the most extensive foreign sale for their goods. Their country has no jurisdiction in foreign nations, and therefore can seldom procure them any monopoly there. They are generally obliged, therefore, to content themselves with petitioning for certain encouragements to exportation.

Of these encouragements what are called Drawbacks seem to be the most reasonable. To allow the merchant to draw back upon exportation, either the whole or a part of whatever excise or inland duty is imposed upon domestic industry, can never occasion the exportation of a greater quantity of goods than what would have been exported had no duty been imposed. Such encouragements do not tend to turn towards any particular employment a greater share of the capital of the country than what would go to that employment of its own accord, but only to hinder the duty from driving away any part of that shares to other employments.

Of Bounties: Bounties upon exportation are, in Great Britain, frequently petitioned for, and sometimes granted to the produce of particular branches of domestic industry. By means of them our merchants and manufacturers, it is pretended, will be enabled to sell their goods as cheap, or cheaper than their rivals in the foreign market. A greater quantity, it is said, will thus be exported, and the balance of trade consequently turned more in favour of our own country. We cannot give our workmen a monopoly in the foreign as we have done in the home market. We cannot force foreigners to buy their goods as we have done our own countrymen. The next best expedient, it has been thought, therefore, is to pay them for buying. It is in this manner that the mercantile system proposes to enrich the whole country, and to put money into all our pockets by means of the balance of trade

Of Treaties of Commerce: When a nation binds itself by treaty either to permit the entry of certain goods from one foreign country which it prohibits from all others, or to exempt the goods of one country from duties to which it subjects those of all others, the country, or at least the merchants and manufacturers of the country, whose commerce is so favoured, must necessarily derive great advantage from the treaty. Those merchants and manufacturers enjoy a sort of monopoly in the country which is so indulgent to them. That country becomes a market both more extensive and more advantageous for their goods: more extensive, because the goods of other nations being either excluded or subjected to heavier duties, it takes off a greater quantity of theirs: more advantageous, because the merchants of the favoured country, enjoying a sort of monopoly there, will often sell their goods for a better price than if exposed to the free competition of all other nations.

Such treaties, however, though they may be advantageous to the merchants and manufacturers of the favoured, are necessarily disadvantageous to those of the favouring country. A monopoly is thus granted against them to a foreign nation; and they must frequently buy the foreign goods they have occasion for dearer than if the free competition of other nations was admitted.

Of Colonies:

Of the Motives for establishing new Colonies: The interest which occasioned the first settlement of the different European colonies in America and the West Indies was not altogether so plain and distinct as that which directed the establishment of those of ancient Greece and Rome.

All the different states of ancient Greece possessed, each of them, but a very small territory, and when the people in any one of them multiplied beyond what that territory could easily maintain, a part of them were sent in quest of a new habitation in some remote and distant part of the world; warlike neighbours surrounded them on all sides, rendering it difficult for any of them to enlarge their territory at home. The colonies of the Dorians resorted chiefly to Italy and Sicily, which, in the times preceding the foundation of Rome, were inhabited by barbarous and uncivilised nations: those of the Ionians and Eolians, the two other great tribes of the Greeks, to Asia Minor and the islands of the Egean Sea, of which the inhabitants seem at that time to have been pretty much in the same state as those of Sicily and Italy. The mother city, though she considered the colony as a child, at all times entitled to great favour and assistance, and owing in return much gratitude and respect, yet considered it as an emancipated child over whom she pretended to claim no direct authority or jurisdiction. The colony settled its own form of government, enacted its own laws, elected its own magistrates, and made peace or war with its neighbours as an independent state, which had no occasion to wait for the approbation or consent of the mother city. Nothing can be more plain and distinct than the interest which directed every such establishment.

Causes of Prosperity of new Colonies: The colony of a civilised nation which takes possession either of a waste country, or of one so thinly inhabited that the natives easily give place to the new settlers, advances more rapidly to wealth and greatness than any other human society.

The colonists carry out with them a knowledge of agriculture and of other useful arts superior to what can grow up of its own accord in the course of many centuries among savage and barbarous nations. They carry out with them, too, the habit of subordination, some notion of the regular government which takes place in their own country, of the system of laws which supports it, and of a regular administration of justice; and they naturally establish something of the same kind in the new settlement.

Of the Advantages which Europe has derived from the Discovery of America, and from that of a Passage to the East Indies by the Cape of Good Hope: Such are the advantages which the colonies of America have derived from the policy of Europe.

What are those which Europe has derived from the discovery and colonization of America?

Those advantages may be divided, first, into the general advantages which Europe, considered as one great country, has derived from those great events; and, secondly, into the particular advantages which each colonizing country has derived from the colonies which particularly belong to it, in consequence of the authority or dominion which it exercises over them.

The general advantages which Europe, considered as one great country, has derived from the discovery and colonization of America, consist, first, in the increase of its enjoyments; and, secondly, in the augmentation of its industry.

The surplus produce of America, imported into Europe, furnishes the inhabitants of this great continent with a variety of commodities which they could not otherwise have possessed; some for conveniency and use, some for pleasure, and some for ornament, and thereby contributes to increase their enjoyments.

Conclusion of the Mercantile System: Smith's argument about the international political economy opposed the idea of Mercantilism. While the Mercantile System encouraged each country to horde gold, while trying to grasp hegemony, Smith argued that free trade would eventually make all actors better off. This argument is the modern 'Free Trade' argument.

Of the Agricultural Systems...: Chapter 9's long title is "Of the Agricultural Systems, or of those Systems of Political Economy, which Represent the Produce of Land, as either the Sole or the Principal, Source of the Revenue and Wealth of Every Country".

That system which represents the produce of land as the sole source of the revenue and wealth of every country has, so far as by that time, never been adopted by any nation, and it at present exists only in the speculations of a few men of great learning and ingenuity in France. It would not, surely, be worth while to examine at great length the errors of a system which never has done, and probably never will do, any harm in any part of the world.

[edit] Book V: Of the Revenue of the Sovereign or Commonwealth

Smith postulated four "maxims" of taxation: proportionality, transparency, convenience, and efficiency. Some economists interpret Smith's opposition to taxes on transfers of money, such as the Stamp Act, as opposition to capital gains taxes, which did not exist in the eighteenth century. [8] Other economists credit Smith as one of the first to advocate a progressive tax;[9][10] Smith wrote, "It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more in proportion."

Of the Expenses of the Sovereign or Commonwealth: Smith uses this chapter to comment on the concept of taxation and expenditure by the state. On taxation Smith wrote,

"The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state. The expense of government to the individuals of a great nation is like the expense of management to the joint tenants of a great estate, who are all obliged to contribute in proportion to their respective interests in the estate. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation."

This points to Smith's more progressive edge, as he was certainly not advocating "flat tax", but something progressively attached to people's "abilities." For the lower echelons, Smith recognised the dehumanising effect that the division of labour can have on workers, what Marx later named "alienation". Moreover he pointed out there was one solution, namely government intervention.

..."the understandings of the greater part of men are necessarily formed by their ordinary employments. The man whose whole life is spent in performing a few simple operations, of which the effects are perhaps always the same, or very nearly the same, has no occasion to exert his understanding or to exercise his invention in finding out expedients for removing difficulties which never occur. He naturally loses, therefore, the habit of such exertion, and generally becomes as stupid and ignorant as it is possible for a human creature to become. The torpor of his mind renders him not only incapable of relishing or bearing a part in any rational conversation, but of conceiving any generous, noble, or tender sentiment, and consequently of forming any just judgment concerning many even of the ordinary duties of private life... But in every improved and civilized society this is the state into which the labouring poor, that is, the great body of the people, must necessarily fall, unless government takes some pains to prevent it."[11]

"Under Smith's model, government involvement in any area other than those stated above would have a negative impact on economic growth. This is because economic growth is determined by the needs of a free market and the entrepreneurial nature of private persons. If there is a shortage of a product its price will rise, and so stimulate producers to produce more, while at the same time attracting new persons into that line of production. If there is an excess supply of a product (more of the product than people are willing to buy), prices will fall and producers will focus their energy and money in other areas where there is a shortage or where there is a need which no one has yet satisfied (thereby creating a new market)."[12]

Of the Sources of the General or Public Revenue of the Society: Smith did not believe that the luxury of the rich was a great benefit to society, when set against the hardships of the poor, and he is often cited[citation needed] as the source of the modern idea of progressive taxation, which he advocated on grounds of fairness. In his discussion of taxes in Book Five, he wrote:

"The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. A tax upon house-rents, therefore, would in general fall heaviest upon the rich; and in this sort of inequality there would not, perhaps, be anything very unreasonable. It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion." [13]

Of War and Public Debts:

"...when war comes [politicians] are both unwilling and unable to increase their [tax] revenue in proportion to the increase of their expense. They are unwilling for fear of offending the people, who, by so great and so sudden an increase of taxes, would soon be disgusted with the war... The facility of borrowing delivers them from the embarrassment... By means of borrowing they are enabled, with a very moderate increase of taxes, to raise, from year to year, money sufficient for carrying on the war, and by the practice of perpetually funding they are enabled, with the smallest possible increase of taxes [to pay the interest on the debt], to raise annually the largest possible sum of money [to fund the war].

...The return of peace, indeed, seldom relieves them from the greater part of the taxes imposed during the war. These are mortgaged for the interest of the debt contracted in order to carry it on.[14]"

Smith then goes on to say that even if money was set aside from future revenues to pay for the debts of war, it seldom actually gets used to pay down the debt. Politicians are inclined to spend the money on some other scheme that will win the favor of their constituents. Hence, interest payments rise and war debts continue to grow larger, well beyond the end of the war.

Summing up, if governments can borrow without check, then they are more likely to wage war without check, and the costs of the war spending will burden future generations, since war debts are almost never repaid by the generations that incurred them.

[edit] See also

- Free Trade

- American School of Economics

- Austrian School of Economics

- Classical economics

- Marginalism

- Neoclassical economics

- Political economy

- Socialism

- The Theory of Moral Sentiments (1759), Adam Smith's other classic

- Wealth (economics)

[edit] Notes

- ^ An Inquiry into the Nature and Causes of the Wealth of Nations, by Adam Smith. London: Methuen and Co., Ltd., ed. Edwin Cannan, 1904. Fifth edition.

- ^ Smith (1776) Book I, Chapter 5, para 1

- ^ Smith (1776) Book I, Chapter 7, para 9

- ^ Smith (1776) Book I, Chapter 7, para 26

- ^ Smith (1776) I, 8, para 39

- ^ Smith (1776) I, 8, para 37

- ^ Smith (1776) Book I, Chapter 10, para 82

- ^ Bartlett, Bruce (2001-01-24). "Adam Smith On Taxes". National Center for Policy Analysis. http://www.ncpa.org/oped/bartlett/jan2401.html. Retrieved on 2008-05-14.

- ^ Reich, Robert B. (1987-04-26). "Do Americans Still Believe In Sharing The Burden?". The Washington Post. d.01. http://pqasb.pqarchiver.com/washingtonpost/access/73816461.html?dids=73816461:73816461&FMT=ABS&FMTS=ABS:FT&date=Apr+26%2C+1987&author=Robert+B.+Reich&pub=The+Washington+Post+(pre-1997+Fulltext)&edition=&startpage=d.01&desc=Do+Americans+Still+Believe+In+Sharing+The+Burden%3F. Retrieved on 2008-05-14.

- ^ Stein, Herbert (1994-04-06). "Board of Contributors: Remembering Adam Smith". Wall Street Journal (Eastern Edition).

- ^ Smith (1776) V, 1, para 178

- ^ R. Conteras, "How the Concept of Development Got Started" University of Iowa Center for International Finance and Development E-Book[1]

- ^ Adam Smith, An Inquiry into the Nature And Causes of the Wealth of Nations (1776). Book V, Chapter 2, Article I: Taxes upon the Rent of House.[2]

- ^ Adam Smith, An Inquiry into the Nature And Causes of the Wealth of Nations (1776). Book V, Chapter 3, Article III: Of Public Debts.[3]

[edit] External links

- 'The Wealth of Nations' online

- The Wealth of Nations at MetaLibri Digital Library

- The Theory of Moral Sentiments at MetaLibri Digital Library

- An Inquiry into the Nature and Causes of the Wealth of Nations at Project Gutenberg

- An Inquiry into the Nature and Causes of the Wealth of Nations, 1776 (accessible by table of contents chapter titles) AdamSmith.org ISBN 1404309985

- Life of Adam Smith, by John Rae, at the Library of Economics and Liberty

- An Inquiry into the Nature and Causes of the Wealth of Nations Google's scan of the book

- Introduction by Ludwig von Mises to the 1952 edition of The Wealth of Nations

- Wealth of Nations Reading Notes