Bond duration

From Wikipedia, the free encyclopedia

| This article does not cite any references or sources. Please help improve this article by adding citations to reliable sources (ideally, using inline citations). Unsourced material may be challenged and removed. (July 2007) |

In finance, the duration of a financial asset measures the sensitivity of the asset's price to interest rate movements. There are various definitions of duration and derived quantities, discussed below. If not otherwise specified, "duration" generally means the Macauly duration, as defined below.

Duration can be defined to be the percentage change in a bond's price function with respect to interest rate, which is the meaningful underlying (the absolute change with respect to interest rate, divided by the current price); this is known in other settings as the λ or Lambda. The absolute change in a bond's price with respect to interest rate, in other settings referred to as the Δ or Delta, is, in the context of bonds, referred to as the dollar duration.

The units of duration are years, and duration is always[note 1] between 0 years and the time to maturity of the bond, with duration equal to time to maturity if and only if the bond is a zero-coupon bond.

The units may seem surprising; it can be understood via dimensional analysis as the ratio of "percentage change in price" over "change in interest rates": the numerator has no dimensions (or units of %), while the denominator has dimensions of 1/Time (units of %/year, as interest rates are quoted is percentage per year). Thus the ratio has dimension of Time, units of Years.

More concretely, this can be understood because more distant cash flows are more sensitive to interest rates, as measured via yield: when taking the present value via discounted cash flows of a bond, one discounts each future cash flow by (1 plus) the yield to the power of the number of years when that cash flow occurs: (1 + y) − n – thus the present value of more distant future cash flows are more sensitive to changes in yield. In particular, the duration of a zero-coupon bond (one with a single cash flow at maturity) is the time to maturity of the bond. How to define the duration of bonds with intermediate cash flows is subtler, as discussed below.

Contents |

[edit] Price

Duration is useful primarily as a measure of the sensitivity of a bond's market price to interest rate (ie yield) movements. It is approximately equal to the percentage change in price for a given change in yield. For example, for small interest rate changes, the duration is the approximate percentage by which the value of the bond will fall for a 1% per annum increase in market interest rate. So a 15-year bond with a duration of 7 would fall approximately 7% in value if the interest rate increased by 1% per annum. [1] In other words, duration is the elasticity of the bond's price with respect to interest rates.

[edit] Definition

The standard definition of duration is Macauly duration, the PV-weighted average number of years to receive each cash flow, defined as:

where:

- i indexes the cash flows,

- P(i) is the present value of each cash payment from an asset (or each expense from a liability) i,

- t(i) is the time in years until each payment will be received (or when each expense is due),

- V is the present value of all cash payments from the asset (or all expenses from the liability, thus net present value) until maturity, and

- D is the duration.

A more naïve definition is to weight by the size of cash flows, not the present value, but, as Macauly discusses, this does not provide a good measure of the sensitivity to changes in interest rates.

Both these definitions give a weighted average (weights sum to 1) of time to receive cash flows, and thus fall between 0 (the minimum time), or more precisely t(1) (the time to the first payment) and the time to maturity of the bond (the maximum time), with equality if and only if the bond only has a single payment at maturity, namely is a zero-coupon bond; in symbols, if cash flows are in order:

with the inequalities being strict unless it has a single cash flow.

[edit] Cash flow

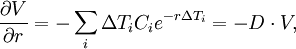

As stated above, the duration is the weighted average term to payment of the cash flows on a bond. For a zero-coupon the duration will be ΔT = Tf − T0, where Tf is the maturity date and T0 is the starting date of the bond. If there are additional cash flows Ci at times Ti, the duration of every cash flow is ΔTi = Ti − T0. From the current market price of the bond V, one can calculate the yield to maturity of the bond r using the formula

Note that in this and subsequent formulae, the symbol r is used for the force of interest, i.e. the logarithm of (1+j) where j is the interest yield expressed as an annual effective yield.

In a standard duration calculation, the overall yield of the bond is used to discount each cash flow leading to this expression in which the sum of the weights is 1:

The higher the coupon rate of a bond, the shorter the duration (if the term of the bond is kept constant). Duration is always less than or equal to the overall life (to maturity) of the bond. Only a zero coupon bond (a bond with no coupons) will have duration equal to the maturity.

Duration indicates also how much the value V of the bond changes in relation to a small change of the rate of the bond. We see that

so that for a small variation  in the redemption yield of the bond we have

in the redemption yield of the bond we have

That means that the duration gives the negative of the relative variation of the value of a bond with respect to a variation in the redemption yield on the bond, forgetting the quadratic and higher-order terms. The quadratic terms are taken into account in the convexity.

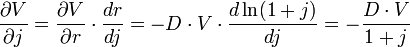

As we have seen above, r = ln(1 + j).

If  (which could be defined as the Modified Duration) is required, then it is given by:

(which could be defined as the Modified Duration) is required, then it is given by:

and this relationship holds good whatever the frequency of convertibility of j.

[edit] Dollar duration

The dollar duration is defined as the product of the duration and the price (value): it is the change in price in dollars, not in percentage, and has units of Dollar-Years (Dollars times Years). It gives the dollar variation in a bond's value for a small variation in the yield.

[edit] Application to VaR

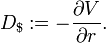

Dollar duration D$ is commonly used for VaR (Value-at-Risk) calculation. If V = V(r) denotes the value of a security depending on the interest rate r, dollar duration can be defined as

To illustrate applications to portfolio risk management, consider a portfolio of securities dependent on the interest rates  as risk factors, and let

as risk factors, and let

denote the value of such portfolio. Then the exposure vector  has components

has components

Accordingly, the change in value of the portfolio can be approximated as

that is, a component that is linear in the interest rate changes plus an error term which is at least quadratic. This formula can be used to calculate the VaR of the portfolio by ignoring higher order terms. Typically cubic or higher terms are truncated. Quadratic terms, when included, can be expressed in terms of (multi-variate) bond convexity. One can make assumptions about the joint distribution of the interest rates and then calculate VaR by Monte Carlo simulation or, in some special cases (e.g., Gaussian distribution assuming a linear approximation), even analytically. The formula can also be used to calculate the DV01 of the portfolio (cf. below) and it can be generalized to include risk factors beyond interest rates.

[edit] Macaulay duration

Macaulay duration, named for Frederick Macaulay who introduced the concept, is the weighted average maturity of a bond where the weights are the relative discounted cash flows in each period.

It will be seen that this is the same formula for the duration as given above.

Macaulay showed that an unweighted average maturity is not useful in predicting interest rate risk. He gave two alternative measures that are useful:

- The theoretically correct Macaulay-Weil duration which uses zero-coupon bond prices as discount factors, and

- the more practical form (shown above) which uses the bond's yield to maturity to calculate discount factors.

The key difference between the two is that the Macaulay-Weil duration allows for the possibility of a sloping yield curve, whereas the algebra above is based on a constant value of r, the yield, not varying by term to payment.

With the use of computers, both forms may be calculated, but the Macaulay duration is still widely used.

In case of continuously compounded yield the Macaulay duration coincides with the opposite of the partial derivative of the price of the bond with respect to the yield—as shown above. In case of yearly compounded yield, the modified duration coincides with the latter.

[edit] Modified duration

In case of n times compounded yield, the relation

is not valid anymore. That is why the modified duration D * is used instead:

where r is the yield to maturity of the bond, and n is the number of cashflows per year.

Let us prove that the relation

is valid. We will analyze the particular case n = 1. The value (price) of the bond is

where i is the number of years after the starting date the cash flow Ci will be paid. The duration, defined as the weighted average maturity, is then

The derivative of V with respect to r is:

multiplying by  we obtain

we obtain

or

from which we can deduce the formula

which is valid for yearly compounded yield.

[edit] Embedded options and effective duration

For bonds that have embedded options, such as puttable and callable bonds, Macaulay duration will not correctly approximate the price move for a change in yield.

In order to price such bonds, one must use option pricing to determine the value of the bond, and then one can compute its delta (and hence its lambda), which is the duration. The effective duration is a discrete approximation to this latter, and depends on an option pricing model.

Consider a bond with an embedded put option. As an example, a $1,000 bond that can be redeemed by the holder at par at any time before the bond's maturity (ie an American put option). No matter how high interest rates become, the price of the bond will never go below $1,000 (ignoring counterparty risk). This bond's price sensitivity to interest rate changes is different from a non-puttable bond with otherwise identical cashflows. Bonds that have embedded options can be analyzed using "effective duration". Effective duration is a discrete approximation of the slope of the bond's value as a function of the interest rate.

where Δ y is the amount that yield changes, and

- V − Δy and V + Δy

are the values that the bond will take if the yield falls by y or rises by y, respectively. However this value will vary depending on the value used for Δ y.

[edit] Average duration

The sensitivity of a portfolio of bonds such as a bond mutual fund to changes in interest rates can also be important. The average duration of the bonds in the portfolio is often reported. The duration of a portfolio equals the weighted average maturity of all of the cash flows in the portfolio. If each bond has the same yield to maturity, this equals the weighted average of the portfolio's bond's durations. Otherwise the weighted average of the bond's durations is just a good approximation, but it can still be used to infer how the value of the portfolio would change in response to changes in interest rates.

[edit] Bond duration closed-form formula

FV = par value

C = coupon payment per period (half-year)

i = discount rate per period (half-year)

a = fraction of a period remaining until next coupon payment

m = number of coupon dates until maturity

P = bond price (present value of cash flows discounted with rate i)

[edit] Convexity

Duration is a linear measure of how the price of a bond changes in response to interest rate changes. As interest rates change, the price does not change linearly, but rather is a convex function of interest rates. Convexity is a measure of the curvature of how the price of a bond changes as the interest rate changes. Specifically, duration can be formulated as the first derivative of the price function of the bond with respect to the interest rate in question, and the convexity as the second derivative.

Convexity also gives an idea of the spread of future cashflows. (Just as the duration gives the discounted mean term, so convexity can be used to calculate the discounted standard deviation, say, of return.)

Note that convexity can be both positive and negative. A bond with positive convexity will not have any call features - ie the issuer must redeem the bond at maturity - which means that as rates fall, its price will rise.

On the other hand, a bond with call features - ie where the issuer can redeem the bond early - is deemed to have negative convexity, which is to say its price should fall as rates fall. This is because the issuer can redeem the old bond at a high coupon and re-issue a new bond at a lower rate, thus providing the issuer with valuable optionality.

Mortgage-backed securities (pass-through mortgage principal prepayments) with US-style 15 or 30 year fixed rate mortgages as collateral are examples of callable bonds.

[edit] PV01 and DV01

PV01 is the present value impact of 1 basis point move in an interest rate. It is often used as a price alternative to duration (a time measure). When the PV01 is in USD, it is the same as DV01 (Dollar Value of 1 basis point).

[edit] Confused notions

Duration, in addition to having several definitions, is often confused with other notions, particularly various properties of bonds that are measured in years.

Duration is sometimes explained inaccurately as being a measurement of how long, in years, it takes for the price of a bond to be repaid by its internal cash flows.[note 2] This quantity is simply  , assuming the tenor is this long, or the tenor otherwise (for instance, if a bond pays 5% per annum and was issued at par, it will take 20 years of these payments to repay its price), and is the duration of a perpetual bond, assuming a flat yield curve at the coupon. Note the absurdity of this definition: given a bond paying 5% per annum with a tenor of 5 years, the duration will be approximately 4.37, while the price of the bond will not be repaid in full until maturity (at 5 years).

, assuming the tenor is this long, or the tenor otherwise (for instance, if a bond pays 5% per annum and was issued at par, it will take 20 years of these payments to repay its price), and is the duration of a perpetual bond, assuming a flat yield curve at the coupon. Note the absurdity of this definition: given a bond paying 5% per annum with a tenor of 5 years, the duration will be approximately 4.37, while the price of the bond will not be repaid in full until maturity (at 5 years).

The Weighted-Average Life is the weighted average of the principal repayments of an amortizing loan, and is longer than the duration.

[edit] See also

- Bond convexity

- Bond valuation

- Immunization (finance)

- Stock duration

- Bond duration closed-form formula

- Yield to maturity

[edit] Lists

[edit] Notes

[edit] References

- ^ "Macaulay Duration" by Fiona Maclachlan, The Wolfram Demonstrations Project.

[edit] External links

- Investopedia’s duration explanation

- Hussman Funds - Weekly Market Comment: February 23, 2004 - Buy-and-Hold For the Duration?

- Online real-time Bond Price, Duration, and Convexity Calculator, by Razvan Pascalau, Univ. of Alabama

- Riskglossary.com for a good explanation on the multiple definitions of duration and their origins.

- Modified duration calculator

|

|||||||||||||||||