Magnetic stripe card

From Wikipedia, the free encyclopedia

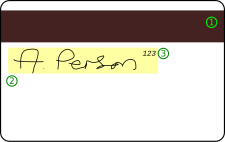

A magnetic stripe card is a type of card capable of storing data by modifying the magnetism of tiny iron-based magnetic particles on a band of magnetic material on the card. The magnetic stripe, sometimes called a magstripe, is read by physical contact and swiping past a reading head. Magnetic stripe cards are commonly used in credit cards, identity cards, and transportation tickets. They may also contain an RFID tag, a transponder device and/or a microchip mostly used for business premises access control or electronic payment.

A number of International Organization for Standardization standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583, and ISO 4909, define the physical properties of the card, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats. They also provide the standards for financial cards, including the allocation of card number ranges to different card issuing institutions.

Contents |

[edit] The magnetic stripe

The process of attaching a magnetic stripe to a plastic card was invented by IBM under a contract with the US government for a security system. Forrest Parry, an IBM Engineer, had the idea of securing a piece of magnetic tape, the predominant storage medium at the time, to a plastic card base. He became frustrated because every adhesive he tried produced unacceptable results. The tape strip either warped or its characteristics were affected by the adhesive, rendering the tape strip unusable. After a frustrating day in the laboratory, trying to get the right adhesive, he came home with several pieces of magnetic tape and several plastic cards. As he walked in the door at home, his wife was ironing and watching TV. She immediately saw the frustration on his face and asked what was wrong. He explained the source of his frustration: inability to get the tape to "stick" to the plastic in a way that would work. She said, "Here, let me try the iron." She did and the problem was solved. The heat of the iron was just high enough to bond the tape to the card.[1]

There were a number of steps required to convert the magnetic striped media into an industry acceptable device. These steps included: 1) Creating the international standards for stripe record content, including which information, in what format, and using which defining codes. 2) Field testing the proposed device and standards for market acceptance. 3) Developing the manufacturing steps need to mass produce the large number of cards required. 4) Adding stripe issue and acceptance capabilities to available equipment. These steps were initially managed by Jerome Svigals of the Advanced Systems Division of IBM, Los Gatos, California from 1966 to 1975.

In most magnetic stripe cards, the magnetic stripe is contained in a plastic-like film. The magnetic stripe is located 0.223 inches (5.66 mm) from the edge of the card, and is 0.375 inches (9.52 mm) wide. The magnetic stripe contains three tracks, each 0.110 inches (2.79 mm) wide. Tracks one and three are typically recorded at 210 bits per inch (8.27 bits per mm), while track two typically has a recording density of 75 bits per inch (2.95 bits per mm). Each track can either contain 7-bit alphanumeric characters, or 5-bit numeric characters. Track 1 standards were created by the airlines industry (IATA). Track 2 standards were created by the banking industry (ABA). Track 3 standards were created by the Thrift-Savings industry.

Magstripes following these specifications can typically be read by most point-of-sale hardware, which are simply general-purpose computers that can be programmed to perform specific tasks. Examples of cards adhering to these standards include ATM cards, bank cards (credit and debit cards including VISA and MasterCard), gift cards, loyalty cards, driver's licenses, telephone calling cards, membership cards, electronic benefit transfer cards (e.g. food stamps), and nearly any application in which value or secure information is not stored on the card itself. Many video game and amusement centers now use debit card systems based on magnetic stripe cards.

Magnetic stripe cloning can be detected by the implementation of magnetic card reader heads and firmware that can read a signature embedded in all magnetic stripes during the card production process. This signature known as a "MagnaPrint" or BluPrint can be used in conjunction with common two factor authentication schemes utilized in ATM, debit/retail point-of-sale and prepaid card applications. [2] [3]

Counterexamples of cards which intentionally ignore ISO standards include hotel key cards, most subway and bus cards, and some national prepaid calling cards (such as for the country of Cyprus) in which the balance is stored and maintained directly on the stripe and not retrieved from a remote database.

[edit] Magnetic stripe coercivity

Magstripes come in two main varieties: high-coercivity (HiCo) at 4000 Oe and low-coercivity (LoCo) at 300 Oe but it is not infrequent to have intermediate values at 2750 Oe. High-coercivity magstripes are harder to erase, and therefore are appropriate for cards that are frequently used or that need to have a long life. Low-coercivity magstripes require a lower amount of magnetic energy to record, and hence the card writers are much cheaper than machines which are capable of recording high-coercivity magstripes. A card reader can read either type of magstripe, and a high-coercivity card writer may write both high and low-coercivity cards (most have two settings, but writing a LoCo card in HiCo may sometimes work), while a low-coercivity card writer may write only low-coercivity cards.

In practical terms, usually low coercivity magnetic stripes are a light brown color, and high coercivity stripes are nearly black; exceptions include a proprietary silver-colored formulation on transparent American Express cards. High coercivity stripes are resistant to damage from most magnets likely to be owned by consumers. Low coercivity stripes are easily damaged by even a brief contact with a magnetic purse strap or fastener. Because of this, virtually all bank cards today are encoded on high coercivity stripes despite a slightly higher per-unit cost.

Magnetic stripe cards are used in very high volumes in the mass transit sector, replacing paper based tickets with either a directly applied magnetic slurry or hot foil stripe. Slurry applied stripes are generally less expensive to produce and are less resilient but are suitable for cards meant to be disposed after a few uses.

[edit] Financial cards

There are up to three tracks on magnetic cards used for financial transactions, known as tracks 1, 2, and 3. Track 3 is virtually unused by the major worldwide networks such as VISA, and often isn't even physically present on the card by virtue of a narrower magnetic stripe. Point-of-sale card readers almost always read track 1, or track 2, and sometimes both, in case one track is unreadable. The minimum cardholder account information needed to complete a transaction is present on both tracks. Track 1 has a higher bit density (210 bits per inch vs. 75), is the only track that may contain alphabetic text, and hence is the only track that contains the cardholder's name.

The information on track 1 on financial cards is contained in several formats: A, which is reserved for proprietary use of the card issuer, B, which is described below, C-M, which are reserved for use by ANSI Subcommittee X3B10 and N-Z, which are available for use by individual card issuers:

Track one, Format B:

- Start sentinel — one character (generally '%')

- Format code="B" — one character (alpha only)

- Primary account number (PAN) — up to 19 characters. Usually, but not always, matches the credit card number printed on the front of the card.

- Field Separator — one character (generally '^')

- Name — two to 26 characters

- Field Separator — one character (generally '^')

- Expiration date — four characters in the form YYMM.

- Service code — three characters

- Discretionary data — may include Pin Verification Key Indicator (PVKI, 1 character), PIN Verification Value (PVV, 4 characters), Card Verification Value or Card Verification Code (CVV or CVK, 3 characters)

- End sentinel — one character (generally '?')

- Longitudinal redundancy check (LRC) — one character (Most reader devices do not return this value when the card is swiped to the presentation layer, and use it only to verify the input internally to the reader.)

LRC is a validity character calculated from other data on the track. It should be noted that most reader devices do not return this value when the card is swiped to the presentation layer, and use it only to verify the input internally to the reader.

Track 2. This format was developed by the banking industry (ABA). This track is written with a 5-bit scheme (4 data bits + 1 parity), which allows for sixteen possible characters, which are the numbers 0-9, plus the six characters : ; < = > ? . The selection of six punctuation symbols may seem odd, but in fact the sixteen codes simply map to the ASCII range 0x30 through 0x3f, which defines ten digit characters plus those six symbols. The data format is as follows:

- Start sentinel — one character (generally ';')

- Primary account number (PAN) — up to 19 characters. Usually, but not always, matches the credit card number printed on the front of the card.

- Separator — one char (generally '=')

- Expiration date — four characters in the form YYMM.

- Service code — three characters

- Discretionary data — as in track one

- End sentinel — one character (generally '?')

- LRC — one character - (It should be noted that most reader devices do not return this value when the card is swiped to the presentation layer, and use it only to verify the input internally to the reader.)

Note: It is possible for these strips to be completely erased if brought close to high strength Neodymium magnets

Note: Commercial Encoders might use '~' for Start sentinel, ';' for separator: such as Datacard, Fargo, Zebra, Magicard, and Persona Encoders/Printers.

Example Code: '~#;data?'

[edit] Driver's licenses (United States)

The data stored on magnetic stripes on American driver's licenses is specified by the American Association of Motor Vehicle Administrators (AAMVA). Not all states use a magnetic stripe on their driver's licenses. For a list of those that do, see the AAMVA list of US License Technology. The AAMVA site also contains a list of the Canadian jurisdictions that use magnetic stripes on their driver's licenses.

The following data is stored on track 1:

- Start Sentinel - one character (generally '%')

- State or Province - two characters

- City - variable length (seems to max out at 13 characters)

- Field Separator - one character (generally '^') (absent if city reaches max length)

- Last Name - variable length

- Field Separator - one character (generally '$')

- First Name - variable length

- Field Separator - one character (generally '$')

- Middle Name - variable length

- Field Separator - one character (generally '^')

- Home Address (house number and street) - variable length

- Field Separator - one character (generally '^')

- Unknown (spaces on mine) - variable length

- End Sentinel - one character (generally '?')

The following data is stored on track 2:

- ISO Issuer Identifier Number (IIN) - 6 digits

- Drivers License / Identification Number - 8 digits

- Field Separator — generally '='

- Expiration Date (YYMM) - 4 digits

- Birth date (YYYYMMDD) - 8 digits

- DL/ID# overflow

The following data is stored on track 3:

- Template V#

- Security V#

- Postal Code

- Class

- Restrictions

- Endorsements

- Sex

- Height

- Weight

- Hair Color

- Eye Color

- ID#

- Reserved Space

- Error Correction

- Security

Note: Each state has a different selection of information they encode, not all states are the same. Note: Some states, such as Texas[4], have laws restricting drivers licenses being swiped under certain circumstances.

[edit] Other card types

Smart cards are a newer generation of card containing an integrated circuit chip. The card may have metal contacts connecting the card physically to the reader, while contactless cards use a magnetic field or radio frequency (RFID) for proximity reading.

Hybrid smart cards include a magnetic stripe in addition to the chip — this is most commonly found in a payment card, so that the cards are also compatible with payment terminals that do not include a smart card reader.

[edit] See also

- Access badge

- Access control

- Common Access Card

- Credential

- Credit card number

- Forrest Parry, the IBM engineer who invented the magstripe card

- ID Card

- Keycard

- MetroCard (New York City)

- Photo identification

- Physical Security

- Proximity card

- Security

- Security engineering

- Smart card

- Stored-value card

[edit] Notes

- ^ Article on Forrest Parry, pages 3-4

- ^ http://www.magneprint.com/

- ^ http://veritechsecurity.com/default.aspx

- ^ Texas law restricting swiping

[edit] External links

- Magnetic Stripe Formats

- Magnetic Stripe Card Standards (from DED Ltd. sales page)

|

|||||