Robert Shiller

From Wikipedia, the free encyclopedia

| Robert Shiller | |

| Born | March 29, 1946 |

|---|---|

| Nationality | American |

| Education | B.A. 1967 Ph.D. in economics 1972 |

| Alma mater | University of Michigan MIT |

| Occupation | economist |

| Spouse(s) | Ginny |

| Children | 2 |

| Parents | Benjamin and Ruth |

| Signature | |

| Website www.econ.yale.edu/~shiller |

|

| New Keynesian economics | |

| Field | Financial economics Behavioral finance |

|---|---|

| Influences | Franco Modigliani |

| Opposed | Jeremy Siegel |

| Influenced | John Y. Campbell Pierre Perron |

| Contributions | Irrational Exuberance, Case-Shiller index |

Robert James "Bob" Shiller (born March 29, 1946[1]) is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was Vice President of the American Economic Association in 2005, and President of the Eastern Economic Association for 2006-2007. He is also the founder and chief economist of the investment management firm MacroMarkets LLC.

Shiller is ranked among the 100 most influential economists of the world.[2]

Contents |

[edit] Career

Shiller received his B.A. from the University of Michigan in 1967 and his Ph.D. from MIT in 1972. He has taught at Yale since 1982 and previously held faculty positions at the Wharton School of the University of Pennsylvania and the University of Minnesota. He has written on economic topics that range from behavioral finance to real estate to risk management, and has been co-organizer of NBER workshops on behavioral finance with Richard Thaler since 1991. His book Macro Markets won TIAA-CREF's first annual Paul A. Samuelson Award. He currently publishes a syndicated column.

In 1981 Shiller published an article in the American Economic Review titled "Do stock prices move too much to be justified by subsequent changes in dividends?" He challenged the efficient markets model, which at that time was the dominant view in the economics profession. Shiller argued that in a rational stock market, investors would base stock prices on the expected receipt of future dividends, discounted to a present value. He examined the performance of the U.S. stock market since the 1920s, and considered the kinds of expectations of future dividends and discount rates that could justify the wide range of variation experienced in the stock market. Shiller concluded that the volatility of the stock market was greater than could plausibly be explained by any rational view of the future.

The behavioral finance school gained new credibility following the October 1987 stock market crash. Shiller's work included survey research that asked investors and stock traders what motivated them to make trades; the results further bolstered his hypothesis that these decisions are often driven by emotion instead of rational calculation. Much of this survey data has been gathered continuously since 1989, and is available at Yale's Investor Behavior Project.

His book Irrational Exuberance (2000) – a New York Times bestseller – warned that the stock market had become a bubble in March 2000 (the very height of the market top) which could lead to a sharp decline.

On CNBC's "How to Profit from the Real Estate Boom" in 2005, he noted that housing price rises could not outstrip inflation in the long term because, except for land restricted sites, house prices would tend toward building costs plus normal economic profit. Meanwhile, co-panelist, David Lereah, continued to cheerlead. In February, Lereah had put out his book Are You Missing the Real Estate Boom? signaling the market top for housing prices. While Shiller repeated his precise timing again for another market bubble, because the general level of nationwide residential real estate prices do not reveal themselves until after a lag of about one year, people did not believe Shiller had called another top until late 2006 and early 2007.[citation needed]

Robert Shiller was awarded the Deutsche Bank Prize in Financial Economics in 2009 for his pioneering research in the field of financial economics, relating to the dynamics of asset prices, such as fixed income, equities, and real estate, and their metrics. His work has been influential in the development of the theory as well as its implications for practice and policy-making. His contributions on risk sharing, financial market volatility, bubbles and crises, have received widespread attention among academics, practitioners and policy makers alike [1].

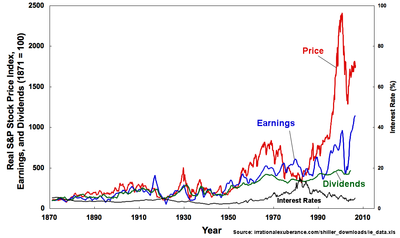

Robert Shiller's plot of the S&P Composite Real Price Index, Earnings, Dividends, and Interest Rates, from Irrational Exuberance, 2d ed.[3] In the preface to this edition, Shiller warns that "[t]he stock market has not come down to historical levels: the price-earnings ratio as I define it in this book is still, at this writing [2005], in the mid-20s, far higher than the historical average. … People still place too much confidence in the markets and have too strong a belief that paying attention to the gyrations in their investments will someday make them rich, and so they do not make conservative preparations for possible bad outcomes."

|

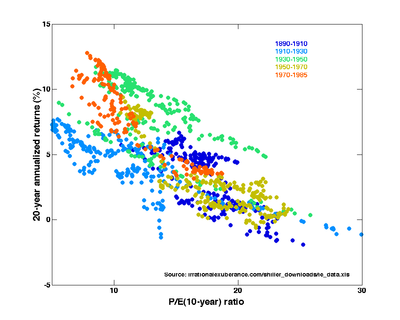

Price-earnings ratios as a predictor of twenty-year returns based on the plot by Robert Shiller (Figure 10.1[3], source). The horizontal axis shows the real price-earnings ratio of the S&P Composite Stock Price Index as computed in Irrational Exuberance (inflation adjusted price divided by the prior ten-year mean of inflation-adjusted earnings). The vertical axis shows the geometric average real annual return on investing in the S&P Composite Stock Price Index, reinvesting dividends, and selling twenty years later. Data from different twenty year periods is color-coded as shown in the key. See also ten-year returns. Shiller states that this plot "confirms that long-term investors—investors who commit their money to an investment for ten full years—did do well when prices were low relative to earnings at the beginning of the ten years. Long-term investors would be well advised, individually, to lower their exposure to the stock market when it is high, as it has been recently, and get into the market when it is low."[3]

|

[edit] Books

- Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism by George A. Akerlof and Robert J. Shiller, Princeton University Press (2009), ISBN 978-0-691-14233-6.

- The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do about It by Robert J. Shiller, Princeton University Press (2008), ISBN 0691139296.

- The New Financial Order: Risk in the 21st Century, by Robert J. Shiller, Princeton University Press (2003), ISBN 0691091722.

- Irrational Exuberance, by Robert J Shiller, Princeton University Press (2000), ISBN 0691050627.

- Macro Markets: Creating Institutions for Managing Society's largest Economic Risks by Robert J. Shiller, Clarendon Press, New York: Oxford University Press (1993), ISBN 0198287828.

- Market Volatility, by Robert J. Shiller, MIT Press (1990), ISBN 026219290X.

[edit] See also

- Behavioral economics

- Journal of Behavioral Finance

- House price index

- Herd behavior

- Case-Shiller index

- The Keynesian Resurgence of 2008 / 2009

[edit] References

- ^ The Closing: Robert Shiller

- ^ "Economist Rankings at IDEAS". University of Connecticut. http://ideas.repec.org/top/top.person.all.html. Retrieved on 2008-09-07.

- ^ a b c Shiller, Robert (2005). Irrational Exuberance (2d ed.). Princeton University Press. ISBN 0-691-12335-7.

[edit] External links

- Homepage of Robert J. Shiller

- Faculty biography at Yale School of Management

- Stocks Revisited: Siegel and Shiller Debate

- "Finance in the 21st Century:" Robert Shiller's op/ed column for Project Syndicate

- Robert Shiller's Workshop in Behavioral Finance

- Robert Shiller research from Yale Economic Review

- The compelling Real DJIA, 1924–now

- The 3 Fed Chair warnings, Real DJIA

- Article on Robert J. Shiller (German language)

- Robert Shiller's interview on the housing crisis with The Politic

- Video conversation on the economy with Shiller and Robert Wright on Bloggingheads.tv.

- Financial Markets with Professor Robert Shiller

- Link to podcast lecture at London School of Economics on Sub Prime Crisis

- Link to Deutsche Bank Prize in Financial Economics

- Robert Shiller's thoughts and insights on the market, including the Shiller Market P/E