Dow Jones Industrial Average

From Wikipedia, the free encyclopedia

The Dow Jones Industrial Average (NYSE: DJI, also called the DJIA, Dow 30, INDP, or informally the Dow Jones or The Dow) is one of several stock market indices, created by nineteenth-century Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow. It is an index that shows how certain stocks have traded.[1] Dow compiled the index to gauge the performance of the industrial sector of the American stock market. It is the second-oldest U.S. market index, after the Dow Jones Transportation Average, which Dow also created.

The average is computed from the stock prices of 30 of the largest and most widely held public companies in the United States. The "industrial" portion of the name is largely historical—many of the 30 modern components have little to do with traditional heavy industry. The average is price-weighted. To compensate for the effects of stock splits and other adjustments, it is currently a scaled average, not the actual average of the prices of its component stocks—the sum of the component prices is divided by a divisor, which changes whenever one of the component stocks has a stock split or stock dividend, to generate the value of the index. Since the divisor is currently less than one, the value of the index is higher than the sum of the component prices.

Contents |

[edit] History

The DJIA was founded on May 26, 1896, and represented the average of twelve stocks from important American industries. Twelve years earlier, Mr. Dow´s initial stock average, containing 9 railroads and 2 Industrial stocks appeared in the Customer`s Afternoon Letter a daily two-page financial news bulletin, that was the precursor of Wall Street Journal. Of those original twelve now, no longer railroad, but purely industrial stocks, only General Electric is currently part of the index.[2] The other eleven were:[3]

- American Cotton Oil Company, distant ancestor of Bestfoods, now part of Unilever

- American Sugar Company, now Domino Foods, Inc.

- American Tobacco Company, broken up in 1911 antitrust action

- Chicago Gas Company, bought by Peoples Gas Light in 1897 (now an operating subsidiary of Integrys Energy Group, Inc.)

- Distilling & Cattle Feeding Company, now Millennium Chemicals, a division of LyondellBasell

- Laclede Gas Light Company, still in operation as The Laclede Group, removed from the Dow Jones Industrial Average in 1899

- National Lead Company, now NL Industries, removed from the Dow Jones Industrial Average in 1916

- North American Company, (Edison) electric company broken up in the 1940s

- Tennessee Coal, Iron and Railroad Company in Birmingham, Alabama, bought by U.S. Steel in 1907

- U.S. Leather Company, dissolved 1952

- United States Rubber Company, changed its name to Uniroyal in 1961, merged private with B.F. Goodrich in 1986, bought by Michelin in 1990.

When it was first published, the index stood at 40.94. It was computed as a direct average, by first adding up stock prices of its components and dividing by the number of stocks in the index. The index hit its all-time low of 28.48 during the summer of 1896, but many of the biggest percentage price moves in The Dow occurred early in its history, as the nascent industrial economy matured. The Dow averaged 5.3% compounded annually for the 20th century, a record Warren Buffett called "a wonderful century"—when he calculated that to achieve that return again, the index would need to reach nearly 2,000,000 by 2100.[4]

On July 30, 1914, when the New York Stock Exchange was closed for the next four months, the index stood at 71.42. Some historians believe the Exchange closed because of a concern that markets would plunge as a result of panic over the onset of World War I. An alternative explanation is that the Secretary of the Treasury, William Gibbs McAdoo, closed the exchange because he wanted to conserve the US gold stock in order to launch the Federal Reserve System later that year with enough gold to keep the US on the gold standard. When the markets reopened on December 12, 1914, the index closed at 54, a drop of 24.39%.[5]

In 1916, the number of stocks in the index was increased to twenty and the new version of the index was 27% smaller than the old index. Finally, it was increased to thirty stocks in 1928, near the height of the "roaring 1920s" bull market. The crash of 1929 and the ensuing Great Depression returned the average to its starting point, almost 90% below its peak, by July 8, 1932, at its intra-day low of 40.56; closing at 41.22. The high of 381.17 on September 3, 1929, would not be surpassed until 1954, in inflation-adjusted numbers. However, the bottom of the 1929 DJIA crash came just 2 1/2 months later on November 13, 1929, when intra-day it was 195.35; closing slightly higher at 198.69.[6]

- The largest one-day percentage gain in the index, 15.34%, happened on March 15, 1933, in the depths of the 1930s bear market.

- The post-World War II bull market, which brought the market well above its 1920s highs, lasted until 1966.

- On November 14, 1972 the average closed above 1,000 (1,003.16) for the first time, during a relatively brief rally in the midst of a lengthy bear market.

The 1980s and especially the 1990s saw a very rapid increase in the average, though severe corrections did occur along the way.

- The largest one-day percentage drop occurred on "Black Monday", October 19, 1987, when the average fell 22.61%.

- On November 21, 1995 the DJIA closed above 5,000 (5,023.55) for the first time.

- On March 29, 1999, the average closed above the 10,000 mark (10,006.78) after flirting with it for two weeks. This prompted a celebration on the trading floor, complete with party hats.

- On May 3, 1999, the Dow achieved its first close above 11,000 (11,014.70).

The uncertainty of the 2000s brought a significant bear market, characterized first by extreme fear on the part of newer investors, then by indecision on whether the following cyclical bull market represented a prolonged temporary bounce or a new long-term trend, and ultimately by widespread resignation and disappointment as the lows were revisited (and, in some areas, surpassed) near the end of the decade.

- On January 14, 2000, the DJIA reached a record high of 11,750.28 in trading before settling at a record closing price of 11,722.98; these two records would not be broken until October 3, 2006.

- The third largest one-day point drop in DJIA history, and largest at the time, occurred on September 17, 2001, the first day of trading after the September 11, 2001 attacks, when the Dow fell 684.81 points, or 7.1%. By the end of that week, the Dow had fallen 1,369.70 points, or 14.3%. A recovery attempt allowed the average to close the year above 10,000.

- By mid-2002, the average had returned to its 1998 level of 8,000.

- On October 9, 2002, the DJIA bottomed out at 7,286.27 (intra-day low 7,197.49 on Oct. 10, 2002), its lowest close since October 1997.

- By the end of 2003, the Dow returned to the 10,000 level.

- On January 9, 2006 the average broke the 11,000 barrier for the first time since June 2001.

- In October 2006, four years after its bear market low, the DJIA set fresh record theoretical, intra-day, daily close, weekly, and monthly highs for the first time in almost seven years, closing above 12,000 for the first time on the 19th anniversary of Black Monday (1987).

- On February 27, 2007, the Dow Jones Industrial Average fell 3.3% (415.30 points), its biggest point drop since 2001. This move was part of a correction that eventually reached below the 12,000 level. It foreshadowed increased levels of volatility not seen since March 2003, including routine 1% moves and occasional moves of greater than 2% in a single session, which continued throughout the year. The initial drop was caused by a global sell-off after Chinese stocks experienced a mini-crash, yet by April 25, the Dow passed 13,000 in trading and closed above the milestone for the first time.

- On July 19, 2007, the average passed the 14,000 level, completing the fastest 1,000-point advance for the index since 1999. One week later, a 450 point intra-day loss, owing to turbulence in the U.S. sub-prime mortgage market and the soaring value of the yuan,[7][8] initiated another correction falling below the 13,000 mark, about 10% from the highs.

- On October 9, 2007, the Dow Jones Industrial Average closed at the record level of 14,164.53. Roughly on-par with the 2000 record when adjusted for inflation, this represented the final high of the cyclical bull.

- On July 2, 2008, with record-high oil and gasoline prices well above $140 per barrel and $4 per gallon, the Dow Jones Industrial Average closed in bear market territory. Two weeks later, its subsequent close below the 11,000 mark for the first time since 2006 was followed by a 500-point rally that accompanied a three-day 15% correction in energy prices.

- On September 15, 2008, a wider financial crisis became evident when Lehman Brothers filed for Chapter 11 bankruptcy. The DJIA lost more than 500 points for only the sixth time in history, returning to its mid-July lows below the 11,000 level. A series of "bailout" packages, including the Emergency Economic Stabilization Act of 2008, proposed and implemented by the Federal Reserve and U.S. Treasury, as well as FDIC-sponsored bank mergers, did not prevent further losses. After two months of extreme volatility, during which the Dow experienced its largest one day point loss, largest intra-day range (more than 1,000 points) and largest daily point gain, the index closed at a new six-year low of 7,552.29 on November 20. The market proceeded with a modest rise to close the year near the 9,000 level, still its worst annual performance since the early 1930s.

- Throughout February 2009, amidst further deterioration in the banking sector, grim economic news, and market doubts as to the effectiveness of further government intervention, the bear market entered another acute phase, as the DJIA methodically approached and surpassed its 2002-03 lows. It closed the month just above the 7,000 level, a nominal loss of half its peak value.

- On March 2, 2009, due to more bad news from AIG and the promise of another bailout for the insurance company, the DJIA dropped below 7,000 for the first time since 1997. By March 9, 2009, the DJIA bottomed out at 6,547.05 (while it had also made an intra-day low of 6,469.95 during a previous session on Mar. 6, 2009), and had lost 20% of its value in only six weeks; its lowest close since April 1997.

[edit] Companies included in the DJIA

The Dow Jones Industrial Average consists of the following 30 companies:[9]

[edit] Former components

The individual components of the DJIA are occasionally changed as market conditions warrant. When companies are replaced, the scale factor used to calculate the index is also adjusted so that the value of the average is not directly affected by the change.

On November 1, 1999, Chevron, Goodyear Tire and Rubber Company, Sears Roebuck, and Union Carbide were removed from the DJIA and replaced by Intel, Microsoft, Home Depot, and SBC Communications. Intel and Microsoft became the first two companies traded on the NASDAQ exchange to be listed in the DJIA. This move was widely (in retrospect) criticized since it involved moving into "tech" names just before the top of the tech bubble. On April 8, 2004, another change occurred as International Paper, AT&T, and Eastman Kodak were replaced with Pfizer, Verizon, and AIG. On December 1, 2005, AT&T returned to the DJIA as a result of the SBC Communications and AT&T merger. Altria Group and Honeywell were replaced by Chevron and Bank of America on February 19, 2008. On September 22, 2008, Kraft Foods replaced American International Group in the index.[10] General Motors and Citigroup are also mentioned as being "on the way out".[11]

[edit] Calculation

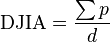

To calculate the DJIA, the sum of the prices of all 30 stocks is divided by a divisor, the DJIA divisor. The divisor is adjusted in case of splits, spinoffs or similar structural changes, to ensure that such events do not in themselves alter the numerical value of the DJIA. The initial divisor was the number of component companies, so that the DJIA was at first a simple arithmetic average; the present divisor, after many adjustments, is less than one (meaning the index is actually larger than the sum of the prices of the components). That is:

where p are the prices of the component stocks and d is the Dow Divisor.

Events like stock splits or changes in the list of the companies composing the index alter the sum of the component prices. In these cases, in order to avoid discontinuity in the index, the Dow divisor is updated so that the quotations right before and after the event coincide:

[edit] Investing

Investing in the DJIA is readily accessible through ETFs. Currently, SSgA State Street Global Advisors offers a family of ETFs, the SPDRs; one of which attempts to match the daily performance of the index (Symbol:DIA). ProShares issued by ProFunds offer other related DJIA ETFs such as the 2x (Symbol:DDM), which attempts to match the daily performance of the DJIA by 200% and the inverse 2x (Symbol:DXD), which attempts to match the inverse daily performance by 200%. ProFunds also issues inverse performance (Symbol:DOG) for a bearish strategy on the index. Additionally, Options trading tied to these ETFs are available.

[edit] Criticism

With the current inclusion of only 30 stocks, critics like Ric Edelman argue that the DJIA is not a very accurate representation of the overall market performance even though it is the most cited and most widely recognized of the stock market indices.[12]

Additionally, the DJIA is criticized for being a price-weighted average, which gives relatively higher-priced stocks more influence over the average than their lower-priced counterparts, but takes no account of the relative size or market capitalization of the components. For example, a $1 increase in a lower-priced stock can be negated by a $1 decrease in a much higher-priced stock, even though the first stock experienced a larger percentage change. In addition, a $1 move in the smallest component of the DJIA has the same effect as a $1 move in the largest component of the index. As of March 2009, IBM is the highest priced stock in the index and therefore has the greatest influence on it. Many critics of the DJIA recommend the float-adjusted market-value weighted S&P 500 or the Dow Jones Wilshire 5000, the latter of which includes all U.S. securities with readily available prices, as better indicators of the U.S. market.

Another issue with the Dow is that not all 30 components open at the same time in the morning. On the days when not all the components open at the start, the posted opening price of the Dow is determined by the price of those few components that open first and the previous day's closing price of the remaining components that haven't opened yet; on those days, the posted opening price on the Dow will be close to the previous day's closing price (which can be observed by looking at Dow price history) and will not accurately reflect the true opening prices of all its components. Thus, in terms of candlestick charting theory, the Dow's posted opening price cannot be used in determining the condition of the market.

[edit] See also

- Closing milestones of the Dow Jones Industrial Average

- List of largest daily changes in the Dow Jones Industrial Average

- Dow Jones Composite Average

- Dow Jones Transportation Average

- Dow Theory

- New York Stock Exchange

- DJIA divisor

- Dow Jones Indexes

[edit] References

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 290. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

- ^ http://www.djindexes.com

- ^ What happened to the original 12 companies in the DJIA?, djindixes.com

- ^ Buffett, Warren (February 2008). "Letter to Shareholders" (PDF). Berkshire Hathaway. http://www.berkshirehathaway.com/letters/2007ltr.pdf. Retrieved on 2008-03-04.

- ^ http://www.djindexes.com/mdsidx/index.cfm?event=showavgstats#no4

- ^ Benjamin M. Anderson (1949). 'Economics and the Public Welfare: A Financial and Economic History of the United States, 1914-1946'. LibertyPress (2nd ed., 1979). p. 219.

- ^ Gold Eagle Financial News

- ^ Financial Markets Magazine news

- ^ http://www.djindexes.com/mdsidx/index.cfm?event=components&symbol=DJI

- ^ Dow Jones (February 11, 2008). Dow Jones to change the composition of the Dow Jones Industrial Average. Press release. http://www.djindexes.com/mdsidx/html/pressrelease/press-release-archive.html#20080211. Retrieved on 2008-02-11.

- ^ Closing Bell, CNBC, March 6, 2009

- ^ Edelman, R: "The Truth about Money 3rd Edition", page 126. HarperCollins, 2004

[edit] External links

[edit] Performance

- Chart of DJIA performance (1928–present) — Linear scale, from Yahoo! Finance

- Chart of DJIA performance (1928–present) — Logarithmic scale, from Yahoo! Finance

- Listing of quotes for all DJIA components, from Yahoo! Finance

|

||||||||

|

|||||