Recession

From Wikipedia, the free encyclopedia

| This article is in need of attention from an expert on the subject. WikiProject Economics or the Economics Portal may be able to help recruit one. (March 2009) |

In economics, a recession is a general slowdown in economic activity in a country over a sustained period of time, or a business cycle contraction.[1][2] During recessions, many macroeconomic indicators vary in a similar way. Production as measured by Gross Domestic Product (GDP), employment, investment spending, capacity utilization, household incomes and business profits all fall during recessions.

Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as increasing money supply, increasing government spending and decreasing taxation.

Contents |

[edit] Identifying

In a 1975 New York Times article, economic statistician Julius Shiskin suggested several economic indicators that identify a recession; these included two successive quarterly declines in GDP.[3] Over time, the other rules have been largely forgotten, and a recession is now often identified as the reduction of a country's GDP (or negative real economic growth) for at least two quarters.[4][5] Some economists prefer a more robust definition of a 1.5% rise in unemployment within 12 months.[6]

In the United States the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) is generally seen as the authority for dating US recessions. The NBER defines an economic recession as: "a significant decline in [the] economic activity spread across the country, lasting more than a few months, normally visible in real GDP growth, real personal income, employment (non-farm payrolls), industrial production, and wholesale-retail sales."[7] Almost universally, academic economists, policy makers, and businesses defer to the determination by the NBER for the precise dating of a recession's onset and end.

[edit] Attributes

| Please help improve this article or section by expanding it. Further information might be found on the talk page. (March 2009) |

A recession has many attributes that can occur simultaneously and can include declines in coincident measures of activity such as employment, investment, and corporate profits.

A severe (GDP down by 10%) or prolonged (three or four years) recession is referred to as an economic depression, although some argue that their causes and cures can be different.[6]

[edit] Predictors of a recession

Although there are no completely reliable predictors, the following are regarded to be possible predictors.[8]

- In the U.S. a significant stock market drop has often preceded the beginning of a recession. However about half of the declines of 10% or more since 1946 have not been followed by recessions.[9] In about 50% of the cases a significant stock market decline came only after the recessions had already begun.

- Inverted yield curve,[10] the model developed by economist Jonathan H. Wright, uses yields on 10-year and three-month Treasury securities as well as the Fed's overnight funds rate.[11] Another model developed by Federal Reserve Bank of New York economists uses only the 10-year/three-month spread. It is, however, not a definite indicator;[12] it is sometimes followed by a recession 6 to 18 months later[citation needed].

- The three-month change in the unemployment rate and initial jobless claims.[13]

- Index of Leading (Economic) Indicators (includes some of the above indicators).[14]

[edit] Government responses

| Please help improve this article or section by expanding it. Further information might be found on the talk page. (March 2009) |

Most mainstream economists believe that recessions are caused by inadequate aggregate demand in the economy, and favor the use of expansionary macroeconomic policy during recessions. Strategies favored for moving an economy out of a recession vary depending on which economic school the policymakers follow. Monetarists would favor the use of expansionary monetary policy, while Keynesian economists may advocate increased government spending by the government to spark economic growth. Supply-side economists may suggest tax cuts to promote business capital investment. Laissez-faire minded economists may simply recommend that the government not interfere with natural market forces.

[edit] Stock market and recessions

| The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. Please improve this article or discuss the issue on the talk page. (September 2008) |

Some recessions have been anticipated by stock market declines. In Stocks for the Long Run, Siegel mentions that since 1948, ten recessions were preceded by a stock market decline, by a lead time of 0 to 13 months (average 5.7 months), while ten stock market declines of greater than 10% in the DJIA were not followed by a recession[15].

The real-estate market also usually weakens before a recession[16]. However real-estate declines can last much longer than recessions[citation needed].

Since the business cycle is very hard to predict, Siegel argues that it is not possible to take advantage of economic cycles for timing investments. Even the National Bureau of Economic Research (NBER) takes a few months to determine if a peak or trough has occurred in the US[17].

During an economic decline, high yield stocks such as fast moving consumer goods, pharmaceuticals, and tobacco tend to hold up better[18]. However when the economy starts to recover and the bottom of the market has passed (sometimes identified on charts as a MACD [19]), growth stocks tend to recover faster. There is significant disagreement about how health care and utilities tend to recover[20]. Diversifying one's portfolio into international stocks may provide some safety; however, economies that are closely correlated with that of the U.S. may also be affected by a recession in the U.S.[21].

There is a view termed the halfway rule [22] according to which investors start discounting an economic recovery about halfway through a recession. In the 16 U.S. recessions since 1919, the average length has been 13 months, although the recent recessions have been shorter. Thus if the 2008 recession followed the average, the downturn in the stock market would have bottomed around November 2008.

[edit] Recession and politics

Generally an administration gets credit or blame for the state of economy during its time.[23] This has caused disagreements about when a recession actually started.[24] In an economic cycle, a downturn can be considered a consequence of an expansion reaching an unsustainable state, and is corrected by a brief decline. Thus it is not easy to isolate the causes of specific phases of the cycle.

The 1981 recession is thought to have been caused by the tight-money policy adopted by Paul Volcker, chairman of the Federal Reserve Board, before Ronald Reagan took office. Reagan supported that policy. Economist Walter Heller, chairman of the Council of Economic Advisers in the 1960s, said that "I call it a Reagan-Volcker-Carter recession.[25] The resulting taming of inflation did, however, set the stage for a robust growth period during Reagan's administration.

It is generally assumed that government activity has some influence over the presence or degree of a recession. Economists usually teach that to some degree recession is unavoidable, and its causes are not well understood. Consequently, modern government administrations attempt to take steps, also not agreed upon, to soften a recession. They are often unsuccessful, at least at preventing a recession, and it is difficult to establish whether they actually made it less severe or longer lasting.[citation needed]

[edit] History of recessions

[edit] Global recessions

There is no commonly accepted definition of a global recession, IMF regards periods when global growth is less than 3% to be global recessions.[26] The IMF estimates that global recessions seem to occur over a cycle lasting between 8 and 10 years. During what the IMF terms the past three global recessions of the last three decades, global per capita output growth was zero or negative.[27]

Economists at the International Monetary Fund (IMF) state that a global recession would take a slowdown in global growth to three percent or less. By this measure, three periods since 1985 qualify: 1990-1993, 1998 and 2001-2002.

[edit] United Kingdom recessions

[edit] United States recessions

According to economists, since 1854, the U.S. has encountered 32 cycles of expansions and contractions, with an average of 17 months of contraction and 38 months of expansion.[7] However, since 1980 there have been only eight periods of negative economic growth over one fiscal quarter or more[28], and four periods considered recessions:

- January-July 1980 and July 1981-November 1982: 2 years total

- July 1990-March 1991: 8 months

- March 2001-November 2001: 8 months

- December 2007-current: 16 months as of April 2009[29]

From 1991 to 2000, the U.S. experienced 37 quarters of economic expansion, the longest period of expansion on record.[28]

For the past three recessions, the NBER decision has approximately conformed with the definition involving two consecutive quarters of decline. However the 2001 recession did not involve two consecutive quarters of decline, it was preceded by two quarters of alternating decline and weak growth.[28]

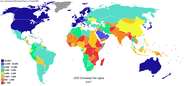

[edit] Current recession in some countries

Official economic data shows that a substantial number of nations are in recession as of early 2009. The US entered a recession at the end of 2007,[30] and 2008 saw many other nations follow suit.

[edit] United States

The United States housing market correction (a consequence of United States housing bubble) and subprime mortgage crisis has significantly contributed to a recession.

The 2008/2009 recession is seeing private consumption fall for the first time in nearly 20 years. This indicates the depth and severity of the current recession. With consumer confidence so low, recovery will take a long time. Consumers in the U.S. have been hard hit by the current recession, with the value of their houses dropping and their pension savings decimated on the stock market. Not only have consumers watched their wealth being eroded – they are now fearing for their jobs as unemployment rises. [31]

U.S. employers shed 63,000 jobs in February 2008[32], the most in five years. Former Federal Reserve chairman Alan Greenspan said on April 6, 2008 that "There is more than a 50 percent chance the United States could go into recession." [33]. On October 1, the Bureau of Economic Analysis reported that an additional 156,000 jobs had been lost in September. On April 29, 2008, nine US states were declared by Moody's to be in a recession. In November 2008 Employers eliminated 533,000 jobs, the largest single month loss in 34 years.[34]. For 2008, an estimated 2.6 million U.S. jobs were eliminated.[35]

Although the US Economy grew in the first quarter by 1%, [36] [37] by June 2008 some analysts stated that due to a protracted credit crisis and "rampant inflation in commodities such as oil, food and steel", the country was nonetheless in a recession.[38] The third quarter of 2008 brought on a GDP retraction of 0.5%[39] the biggest decline since 2001. The 6.4% decline in spending during Q3 on non-durable goods, like clothing and food, was the largest since 1950.[40]

A Nov 17, 2008 report from the Federal Reserve Bank of Philadelphia based on the survey of 51 forecasters, suggested that the recession started in April 2008 and will last 14 months [41]They project real GDP declining at an annual rate of 2.9% in the fourth quarter and 1.1% in the first quarter of 2009. These forecasts represent significant downward revisions from the forecasts of three months ago.

A December 1, 2008, report from the National Bureau of Economic Research stated that the U.S. has been in a recession since December 2007 (when economic activity peaked), based on a number of measures including job losses, declines in personal income, and declines in real GDP.[42]

[edit] Other countries

| This section does not cite any references or sources. Please help improve this article by adding citations to reliable sources (ideally, using inline citations). Unsourced material may be challenged and removed. (February 2008) |

A few other countries have seen the rate of growth of GDP decrease, generally attributed to reduced liquidity, sector price inflation in food and energy, and the U.S. slowdown. These include the United Kingdom, Canada, Japan, Australia, China, India, New Zealand and the Eurozone. In some, the recession has already been confirmed by experts, while others are still waiting for the fourth quarter GDP growth data to show two consecutive quarters of negative growth. India along with China is experiencing an economic slowdown but not a recession.

[edit] See also

- Economic depression

- Economic stagnation

- Great Depression - August 1929 to September 1939: longest (and deepest) recession of the 20th century

- List of recessions in the United States - A list of important recessions in the United States

- Late 2000s recession

- Stagflation

[edit] Causes of recessions

[edit] Effects of recessions

[edit] References

- ^ "Recession". Merriam-Webster Online Dictionary. http://www.merriam-webster.com/dictionary/recession. Retrieved on 19 November 2008.

- ^ "Recession definition". Encarta® World English Dictionary [North American Edition]. Microsoft Corporation. 2007. http://encarta.msn.com/encnet/features/dictionary/DictionaryResults.aspx?refid=1861699686. Retrieved on 19 November 2008.

- ^ The risk of redefining recession, Lakshman Achuthan and Anirvan Banerji, Economic Cycle Research Institute, May 7, 2008

- ^ "Financial Check Glossary". Bloomberg.com. 2000. http://www.bloomberg.com/invest//glossary/bfglosr.htm. Retrieved on 19 November 2008.

- ^ "Recession definition". BusinessDictionary.com. 2007-2008. http://www.businessdictionary.com/definition/recession.html. Retrieved on 19 November 2008.

- ^ a b http://clubtroppo.com.au/2008/11/23/what-is-the-difference-between-a-recession-and-a-depression/ "What is the difference between a recession and a depression?" Saul Eslake Nov 2008

- ^ a b "Business Cycle Expansions and Contractions". National Bureau of Economic Research. http://www.nber.org/cycles.html. Retrieved on 19 November 2008.

- ^ A Estrella, FS Mishkin. "Predicting U.S. Recessions: Financial Variables as Leading Indicators". MIT Press. http://www.mitpressjournals.org/doi/pdfplus/10.1162/003465398557320?cookieSet=1.

- ^ Jeremy Siegel, Stocks for the Long Run

- ^ Grading Bonds on Inverted Curve By Michael Hudson

- ^ Wright, Jonathan H., The Yield Curve and Predicting Recessions (March 2006). FEDs Working Paper No. 2006-7.

- ^ Signal or Noise? Implications of the Term Premium for Recession Forecasting

- ^ Labor Model Predicts Lower Recession Odds

- ^ Leading Economic Indicators Suggest U.S. In Recession January 21, 2008

- ^ Siegel, Jeremy J. (2002). Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies, 3rd, New York: McGraw-Hill, 388. ISBN 9780071370486

- ^ Housing Has A Strong Correlation To Stocks Chris Ciovacco, September 19, 2006

- ^ Recession Predictions and Investment Decisions by Allan Sloan, December 11, 2007

- ^ Recession? Where to put your money now. Shawn Tully, February 6 2008

- ^ crossover

- ^ Rethinking Recession-Proof Stocks Joshua Lipton 01.28.08

- ^ Recession Stock PicksDouglas Cohen, January 18, 2008

- ^ http://online.wsj.com/article/SB122635740974515379.html NOVEMBER 11, 2008 Recession Puts Halfway Rule to the Test, By DAVID GAFFEN

- ^ Economy puts Republicans at risk 29 January 2008

- ^ The Bush Recession Prepared by: Democrat staff, Senate Budget Committee,July 31, 2003

- ^ Ready for a Real Downer Monday, Nov. 23, 1981 By GEORGE J. CHURCH

- ^ The Recession that Almost Was. Kenneth Rogoff, International Monetary Fund, Financial Times, April 5, 2002

- ^ Global Recession Risk Grows as U.S. `Damage' Spreads

- ^ a b c http://www.bea.gov/national/xls/gdpchg.xls

- ^ It's official: Recession since Dec. '07

- ^ NBER Business Cycle Dating Comittee. "Determination of the December 2007 Peak in Economic Activity." 11 December, 2008. [1]

- ^ Economic Crisis: When will it End? IBISWorld Recession Briefing " Dr. Richard J. Buczynski and Michael Bright, IBISWorld, January 2009

- ^ [2]Job Loss Predictions

- ^ Recession unlikely if US economy gets through next two crucial months

- ^ http://www.nytimes.com/2008/12/06/business/economy/06jobs.html

- ^ http://www.statesmanjournal.com/article/20090110/NEWS/901100332

- ^ Real GDP First-Quarter 2008 Preliminary Estimate :: Brent Meyer :: Economic Trends :: 06.03.08 :: Federal Reserve Bank of Cleveland

- ^ Fragile economy improves but not out of woods yet: Financial News - Yahoo! Finance

- ^ Why it's worse than you think, 16 June 2008, Newsweek.

- ^ GROSS DOMESTIC PRODUCT: THIRD QUARTER 2008

- ^ U.S. Economy Contracts Most Since the 2001 Recession

- ^ http://www.philadelphiafed.org/research-and-data/real-time-center/survey-of-professional-forecasters/2008/survq408.cfm?loc=interstitialskip Fourth Quarter 2008 Survey of Professional Forecasters Release Date: November 17, 2008

- ^ http://www.usatoday.com/money/economy/2008-12-01-recession-nber-statement_N.htm Text of the NBER's statement on the recession

[edit] External links

- Recession? Depression? What's the difference? About.com

- Business Cycle Expansions and Contractions The National Bureau Of Economic Research

- Independent Analysis of Business Cycle Conditions - American Institute for Economic Research (AIER)

- RECESSION.ORG - Economic Recession Information & U.S. Recession History

- Market Mayhem and Meltdown